In the first two parts of this series, we explained why Rezolv is investing in Bulgaria and Romania. We focused on the impact that the development of renewable energy will have on emissions and human health. We also outlined why the energy transition is necessary for long-term economic competitiveness.

However, there is one other aspect we didn’t consider which is also driving change: large-scale renewable energy projects like those Rezolv is developing in Romania and Bulgaria will contribute to both countries’ climate targets.

Let’s consider Romania first. Last time, we mentioned that the percentage of electricity generated from fossil fuels in Romania dropped below 30% for the first time in 2023, with overall renewables capacity increasing from 43.1% in 2022 to 50.4%. 65% of that renewables capacity was hydropower, but we shouldn’t understate the progress that was made last year, particularly on solar power. As in Bulgaria, 2023 was the year when Romanian solar turned the corner, with over 1GW of new capacity installed, a 308% increase on 2022 – making solar PV the fastest-growing power source in the country.

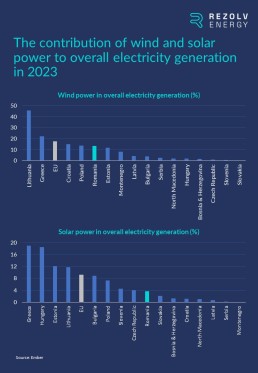

To put that into a regional context, here’s how Romania stacked up against other countries in Central & South Eastern Europe in 2023 in terms of both wind and solar capacity:

Wind capacity also increased very slightly last year in Romania – but from a much higher starting point. On both fronts, though, there is more work to do to reach the EU average, let alone catch the countries that are leading the way in the region.

Romania’s renewable energy target keeps increasing

It’s also worth considering the progress made in 2023 against Romania’s 2030 renewable energy target. The reality is that its impact was diluted by the fact that that target has been steadily increasing as the EU’s level of ambition has risen.

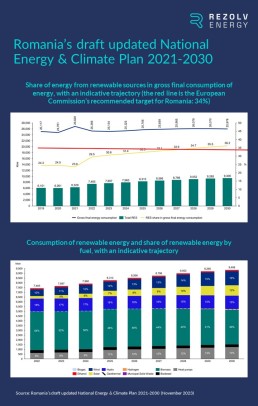

Romania’s Integrated National Energy and Climate Change Plan (NECP) for 2021-2030, which was submitted to the European Commission in 2018, set a target for the total share of renewable energy in final gross energy consumption of 27.9% by 2030.

The revised NECP, submitted in April 2020, increased that target to 30.7% – short of the Commission’s recommendation of at least 34%, but still a significant increase.

Most recently, the revised draft of the NECP that was submitted in November 2023 indicated that Romania could reach 36% by 2030 – with wind and solar the main contributors:

Attitudes are also being shaped by the renewable energy potential in the region

Romania’s increased ambition is not just a response to pressure from the European Commission: it’s also driven by Romania’s enormous renewable energy potential. For wind power, there are exceptional natural resources in some parts of the country, particularly in Constanța county where Rezolv’s 600MW Dunarea East & West wind farms will be built. But it’s not only along the Black Sea coast. Rezolv’s other onshore wind project in Romania, VIFOR, is in Buzău county, more than 200km inland – where the proximity to the Carpathian Mountains also gives rise to high wind yields.

The solar potential is huge too. Romania joined the International Solar Alliance during COP28. In making the announcement, Energy Minister Sebastian Burduja estimated the country’s technical solar potential at 19.35GW (25.80 TWh), with 18.05GW (24.18 TWh) deemed economically viable under minimum cost scenarios. These are not small numbers, and it’s primarily, obviously, because the whole of South Eastern Europe enjoys plenty of sunshine.

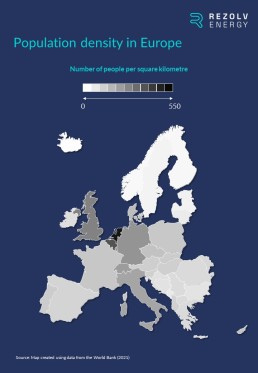

It’s also about available land, though. Very large-scale solar projects like those Rezolv is developing require large, flat sites (as well as good solar irradiation and grid access). Our 229MW St. George project in Bulgaria, for example, will cover 165 hectares. Dama Solar, our 1,044MW solar project in western Romania, will be significantly larger than that.

Sites of that size are clearly not available everywhere, but they are a bit easier to find in Central & South Eastern Europe than some parts of Western Europe – because it is not the most densely populated part of Europe:

Bulgaria: a case study of how broader government priorities are driving the energy transition

Political attitudes in Bulgaria also illustrate the fact that EU targets are not the only driver of change in this region.

Ahead of the unveiling of the EU’s climate target for 2040, 11 member states jointly called on the EU to set “an ambitious climate target for 2040…[which] should be in line with the long-term temperature goal of 1.5°C… The target should also ensure that the EU is fully on track to climate neutrality by 2050 at the latest aiming to achieve negative emissions thereafter.”

Bulgaria was the only Central & Eastern European country in the group of 11 member states that signed that letter. Why Bulgaria?

In part, it is the same factors that are driving the commitment to the energy transition across this region: the need to secure energy supplies, enhance energy independence and drive down energy prices – all of which have become political priorities everywhere since the start of the war in Ukraine.

As in Romania, it is also an acknowledgement of the renewable energy potential in Bulgaria. For example, Bulgaria is on track to achieve its 2030 NECP target for solar power about seven years ahead of schedule, and a recent study from the Centre for the Study of Democracy found that Bulgaria could add between 3.8GW and 4.2GW of wind capacity by 2030, and another 5GW by 2040; offshore wind could add more than 150GW on top of that.

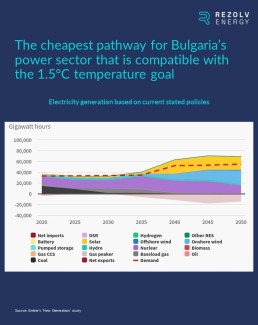

Indeed, based on a study by Ember, the cheapest pathway for Bulgaria’s power sector which is compatible with the 1.5°C temperature goal mentioned in the letter involves the installation of huge amounts of solar and onshore wind:

And it’s not just the EU member states…

We are seeing similar levels of commitment to renewables from non-EU member states in the region as well. For example:

- By 2030, North Macedonia has committed to reducing its net greenhouse gas emissions by 82% compared to 1990 levels. The energy transition will be key to achieving this given how dependent the country has historically been on coal. This commitment is already being backed up by action. Last year, North Macedonia posted 160% growth in new renewables capacity and, at COP28, announced a coal phase-out by 2030.

- Under its draft NECP, Serbia will, by 2030, aim to increase the share of renewables in electricity production to 45.2% and deliver a 40.3% reduction in greenhouse gas emissions compared to 1990.

- Bosnia & Herzegovina aims to deliver a renewable energy share of 43.6% by 2030, most of which will be solar.

Renewables targets will continue to grow – which also represents a big, but not insurmountable challenge

Countries in Central & South Eastern Europe are not purely motivated by the requirement to meet climate targets, but, at the same time, no one is in any doubt that the pressure from Brussels will only continue to increase.

Indeed, on 6 February 2024, the European Commission published a detailed impact assessment on possible pathways to reach the agreed goal of making the EU climate neutral by 2050. Based on the assessment, the Commission expects renewable energy, “complemented by nuclear energy”, to generate over 90% of the electricity consumption in the EU in 2040. A legislative proposal will be made after the European elections, and it will need to be agreed with the European Parliament and member states – but even a watered-down version of this proposal will translate into more ambitious renewable energy targets for every member state.

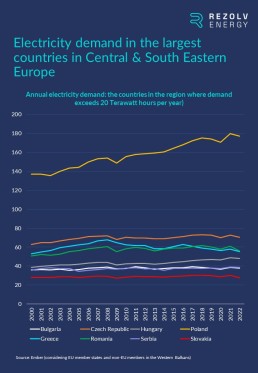

This will be particularly challenging for the largest and most heavily industrialised countries. If you take ‘Central & South Eastern Europe’ to mean the EU member states in the region plus the non-EU countries in the Western Balkans, there are only four countries where annual electricity demand exceeds 50 Terawatts – Poland, the Czech Republic, Romania and Greece:

In these countries, increasing the share of renewable energy is a bigger challenge than it is in smaller countries, because each percentage point represents more gigawatts of renewable capacity.

Summing up: significant progress has been made over the last 12 months, but even more urgency is needed

The political support we are seeing for renewable energy is, of course, not only a consequence of ever-increasing EU targets – but those targets certainly do help focus minds. The truth is that 2030 is not very far away, and large-scale renewable energy projects – the quickest and most effective route to meeting those targets – take time to develop. The progress we have seen across the region over the last 12 months is a great start, but even more urgency is needed.

What is coming up next time?

Some countries’ 2030 targets look tougher to achieve than others’, and next time we are going to be looking at one member state which still has plenty to do: the Czech Republic…

You might also like

15 October 2025

VIFOR Wind Farm Progress Update

The construction of Rezolv’s VIFOR wind farm in Romania is moving forward at pace.

14 October 2025

Central & Southeastern Europe’s renewables revolution: which countries are leading the race to decarbonise?

Earlier in this series, at the end of Q1 2024, we considered 2030 emissions targets and provided a ‘status update’ on the progress the countries in Central & Southeastern Europe (CEE) had made in 2023.

6 October 2025

Rezolv offers 100 free training places in renewable energy, in partnership with RenewAcad

Rezolv Energy, one of the leading renewable energy producers in Central and Southeastern Europe, is offering 100 free training places in Buzău County, Romania, to help local people gain the skills needed for tomorrow’s clean energy jobs.

3 October 2025

Rezolv Energy receives EU grant for battery energy storage project in Bulgaria

Rezolv Energy has secured a grant from the European Union under the NextGenerationEU programme for the deployment of a Battery Energy Storage System (BESS) at the St. George solar power plant in Bulgaria.

14 August 2025

Rezolv Energy a major winner in Romania’s second contracts for difference (CfD) auction

Rezolv Energy, backed by growth market sustainable infrastructure investor Actis, has been awarded three contracts for difference (CfDs) by the Romanian Ministry of Energy in the country’s second CfD auction.

31 July 2025

Rezolv Energy selects partners for Phase 2 of the VIFOR wind farm in Romania

Rezolv Energy, backed by growth market sustainable infrastructure investor Actis, has selected its key partners for Phase 2 of the VIFOR Wind Farm in Buzău County, Romania.

22 July 2025

Rezolv Energy signs incremental €331 million finance facilities to bring its VIFOR wind farm in Romania to full capacity

Actis-backed Rezolv Energy, through its project subsidiary First Look Solutions S.R.L., has signed incremental project finance facilities of up to €331 million to support construction of the 269MW second phase of its VIFOR wind farm in Buzău County, Romania. Phase 2 will take the project to its full 461MW capacity.

1 July 2025

Rezolv Energy and SCION Launch Nature and CleanTech Accelerator for Early-Stage Ventures in Bulgaria and Romania

Rezolv Energy and SCION have announced the launch of the SCION Accelerator, a 10-week programme to support early-stage teams working at the intersection of ecology, science and scalable technology in Bulgaria and Romania.

19 February 2025

Why has the retail sector moved into the big leagues when it comes to renewable energy procurement?

In the last article in this series, we undertook a deep-dive into the ICT industry and why it – and the growth of data centres specifically – is so significant for the development of renewable energy in Central and Southeastern Europe.