We recently kicked off this series of articles on the clean energy transition in Central & South Eastern Europe by answering the question: why is Rezolv investing in Bulgaria?

By the time we announced St. George, our 229MW solar PV project in north-eastern Bulgaria, we had already confirmed that we would be building more than 2GW of clean power in Romania, through three separate projects: Dama Solar, a 1,044MW plant in north-west Arad County, which will be the largest solar project anywhere in Europe once it is operational; the Dunarea East & West wind farms in Constanța County which, at 600MW, will become one of Europe’s largest onshore wind projects; and the 450MW VIFOR wind farm in Buzău County. The wind farms are being developed by Rezolv in partnership with Low Carbon.

So, let’s now consider Romania in more detail: why is Rezolv investing there?

An ‘emissions first’ approach in Romania too?

For Bulgaria, we talked about an ‘emissions first’ approach: Bulgarian electricity production is still heavily dependent on fossil fuels – specifically brown coal, or lignite, which causes the highest CO2 emissions per ton when burned, one-third more than hard coal and three times as much as natural gas. Replacing lignite production with renewables delivers the maximum possible emissions reduction impact. Does the same ‘emissions first’ rationale justify investing in renewables in Romania?

The answer is ‘yes’, but the context in Romania is a bit different.

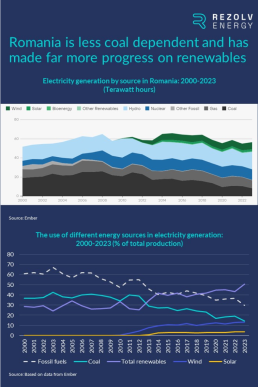

Last year, the percentage of electricity generated from fossil fuels dropped below 30% for the first time. That’s primarily explained by the growth of renewable energy, with overall renewables capacity increasing from 43.1% in 2022 to 50.4% in 2023, comfortably the highest level it has ever been:

Doesn’t Romania’s much stronger track record on renewables undermine the ‘emissions first’ argument for investing there? No.

For two main reasons:

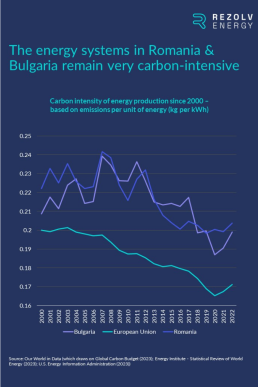

First, despite everything that we have just outlined, the carbon intensity of energy production in Romania – the amount of CO2 emitted per unit of energy – is even higher in Romania than it is in Bulgaria:

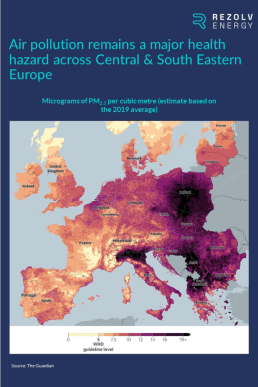

Second, air quality in Romania remains a significant problem. When we considered Bulgaria in the first article of this series, we explained that while there are many different air pollutants, one of the most significant for human health is fine particulate matter (PM2.5), because exposure to PM2.5 at above recommended levels is a leading cause of premature death and disease (particularly stroke, cancer and respiratory disease).

While average air quality is worse in Bulgaria than it is in Romania, Romania is still fourth on the EU list when it comes to premature deaths attributable to exposure to PM2.5 – behind only Bulgaria, Poland and Hungary. This map illustrates the point very clearly:

A rapid reduction in energy sector emissions will therefore have more than a significant climate impact: it will also have a direct, tangible impact on the health of the Romanian public.

The energy transition is an economic priority in Romania as well

There is one other very important area in which Romania and Bulgaria are similar. In the previous article, we showed how Bulgaria is amongst the most heavily industrialised economies anywhere in Europe. The situation in Romania is almost exactly the same, with much of Romania’s industry also integrated into the supply chains of major multinational companies – many of whom have committed to comprehensive net-zero and renewable energy targets. To remain part of those supply chains – which, in many cases, will be essential for their long-term viability – those Romanian firms will need to meet their major customers’ renewable energy consumption requirements by procuring clean power.

This reality has started to dawn on many energy-intensive companies in Romania. Creative Communication recently ran a survey of 428 Romanian companies that consume more than 10GWh of power per year, asking them for their views on procuring renewable energy through power purchase agreements (PPAs). At first sight, the results might not look overwhelmingly positive, but they are actually very encouraging:

Why is this encouraging? Because if that same survey had been run 12 months ago, there would have been far higher numbers in the “I don’t know what a PPA is” and “We know about the PPA model, but we are not interested in entering into one” categories.

How to accelerate the PPA market in Romania

It is also encouraging because some of the concerns that we know exist – specifically, in the 40% of businesses that said they were waiting for the market to mature before making a decision – can be addressed. In two main ways:

First, this problem will ease over time. The first PPA was only signed in Romania in 2021, so it is a relatively new concept. There is a change in buying habits. You are asking a company that has always bought electricity annually through an energy trader to sign a contract for a 10+ year period directly with an energy producer. It’s a big step, in terms of financial commitment but also confidence and risk appetite, and it’s therefore understandable that buyers are cautious. However, expect to see a raft of PPAs being signed in 2024 – and this, gradually, will change the game. In the meantime, the task for stakeholders in the renewable energy sector – including Rezolv – will be to continue to educate consumers and help them through this change in paradigm. As the survey shows, there is a knowledge gap but it’s also a psychological barrier more than anything else, and it can be overcome.

Second, there is one remaining regulatory barrier holding the PPA market in Romania back – which is even more straightforward to fix. This concerns Guarantees of Origin (GOs). GOs prove to a final customer that the energy they are buying was produced from renewable sources. They are a critical component of corporate PPAs. Without them, PPA buyers cannot verify the type of electricity they are using and are unable to meet strict carbon accounting requirements, or prove compliance with RE100 and SBTi rules. Crucially, for the multinational firms that are currently driving most of the demand for PPAs, GOs also need to be transferrable between EU member states.

It is this ability to transfer GOs across borders within the EU that is the problem in Romania because it is only possible if the GOs are certified by a European body called the Association of Issuing Bodies (AIB) – and Romania is one of only two member states which is not a member of the AIB or in the process of applying to join. This is a clear barrier to the development of the PPA market and the renewable energy industry in Romania, via the main trade associations, are pushing for the government to remedy it very soon. This is also important for Romania as the EU has placed access to PPAs as one of the key elements of the electricity market reform that was agreed late last year.

PPAs are not just a way for corporates to benefit from the energy transition, they are a way for them to contribute

Applying for AIB membership is the policy change which would have the biggest impact on the renewable energy sector in Romania because, as we touched on in the first article of this series, PPAs are not just about corporate off-take. They also help finance renewable energy projects, so removing barriers to PPAs is the quickest way to increase renewable energy capacity.

Explaining this connection between PPAs and project financing is an important part of the education process in Romania. Happily, the message is getting through. Increasingly, Romanian companies are understanding that the opportunity in a PPA is not just to ensure their long-term supply of clean power at a stable price. It will also help build the project that will supply them. A PPA is therefore not just a way for them to benefit from the energy transition, it is a way for them to contribute. Also, they can claim “additionality” because they are supporting renewable energy generation which is new rather than already available – so, through a PPA, they are delivering a material impact on reducing fossil generation and displacing carbon emissions.

This is particularly attractive if the off-taker knows that the project will be constructed and operated to the highest ESG standards: that the developer is fully committed to protecting nature at the project sites, and to leaving a lasting, positive legacy in the local communities.

Take Rezolv’s Dama Solar project in Arad, for example, where there will be a particular emphasis on integrating symbiotic agricultural activities. The land on which the project will be built has been over-cultivated in the past, so is now poor quality from a farming perspective. As part of the project plan, it will be returned to pasture, with sheep managing the vegetation through grazing. We are also looking to incorporate beekeeping and other measures to increase biodiversity. As with all of our projects, there will also be a long-term investment programme at Dama Solar which will go well beyond local job creation to ensure that the project creates economic value and a range of other benefits to the people of Arad. It is a project with which any corporation would be proud to be associated.

Summing up

Romania has made good progress on renewables compared to other countries in SEE. However, that does not undermine the ‘emissions first’ motivation for investing in renewables there because Romanian energy production is still carbon intensive and air quality remains poor across the country. The rapid development of the PPA market is the fastest way to expand renewables capacity. And the quickest way to release the handbrake on PPAs would be Romania announcing its application to join the AIB.

What is coming up next time?

There is one other factor which helps answer the “why Romania?” question that hasn’t been explored here: Romania has enormous renewable energy potential, which is one reason why its 2030 fossil fuel reduction and renewables growth targets remain challenging.

And in the next article in this series, this is the topic we will be exploring. Turning our attention to the whole of Central & South Eastern Europe, we will see which countries in the region have made the most progress on wind and solar, and which have the most still to do…

You might also like

1 July 2025

Rezolv Energy and SCION Launch Nature and CleanTech Accelerator for Early-Stage Ventures in Bulgaria and Romania

Rezolv Energy and SCION have announced the launch of the SCION Accelerator, a 10-week programme to support early-stage teams working at the intersection of ecology, science and scalable technology in Bulgaria and Romania.

19 February 2025

Why has the retail sector moved into the big leagues when it comes to renewable energy procurement?

In the last article in this series, we undertook a deep-dive into the ICT industry and why it – and the growth of data centres specifically – is so significant for the development of renewable energy in Central and Southeastern Europe.

16 October 2024

Rezolv Energy secures up to €90 million in debt financing from the IFC and Raiffeisen Bank International for the St. George solar park in Bulgaria

Rezolv Energy, an independent power producer backed by Actis, has secured up to €90 million in debt financing from the International Finance Corporation (IFC) and Raiffeisen Bank International to support the construction of the ‘St. George’ solar park in north-eastern Bulgaria.

30 September 2024

Rezolv Energy and A2A sign Virtual Power Purchase Agreement for 150 GWh of wind energy in Romania

A2A, an Italian group active in the energy, water and environment sectors, has signed a 7-year Virtual Power Purchase Agreement (VPPA) with Rezolv Energy, an independent power producer backed by Actis.

18 September 2024

ICT companies should act now to secure the green power needed for data centre growth

In the last article in this series, we explored the regulations, directives and other EU initiatives which are – or will be – the most important in encouraging European companies to switch to buying more renewable power.

6 September 2024

Ardagh Glass Packaging-Europe enters Bulgarian renewable energy market by signing Virtual Power Purchase Agreement with Rezolv Energy

Ardagh Glass Packaging-Europe (AGP-Europe), an operating business of Ardagh Group, announced today that it has entered a long-term Virtual Power Purchase Agreement (VPPA) with Rezolv Energy’s St. George solar photovoltaic (PV) project in Bulgaria, securing renewable electricity for its glass manufacturing operations across Europe from April 2026.

6 September 2024

Rezolv Energy hands contracts to three companies, including Solarpro and CMC Europe, to build the ‘St. George’ solar park in Bulgaria

Actis-backed Rezolv Energy has selected three companies – CMC Europe, Solarpro and Green Solar Energy – to build the 229MW ‘St. George’ solar park in Silistra Municipality in Northeastern Bulgaria. Construction work is due to start very shortly, with the plant coming onstream next year.

18 July 2024

Which regulatory changes at EU level are doing – or will do – the most to push companies towards renewable power?

In the last article in this series, we took a deep-dive into the telecommunications industry, a sector which, according to industry estimates, accounts for 1-2% of all energy consumed globally – and which is amongst the fastest-growing for renewable energy power purchase agreements (PPAs).

11 July 2024

Why is the telecoms industry amongst the fastest-growing sectors for renewable energy PPAs?

In the last article in this series, we took the first of several deep-dives we will be taking into industry sectors which are heavily impacted by the energy transition – and which are driving demand for renewable energy power purchase agreements (PPAs) in Central & South Eastern Europe.