Which regulatory changes at EU level are doing – or will do – the most to push companies towards renewable power?

In the last article in this series, we took a deep-dive into the telecommunications industry, a sector which, according to industry estimates, accounts for 1-2% of all energy consumed globally – and which is amongst the fastest-growing for renewable energy power purchase agreements (PPAs).

In that piece, we identified three of the most important factors driving the interest from telecoms companies in PPAs – to summarise:

- Telecoms operators use a lot of electricity, and decisions over renewable power cannot wait if the sector is to meet its sustainability commitments

- Renewable energy buying is being driven by the search for cost savings

- European regulations are driving change

This time, we are going to consider this final point in more detail, but in a broader context: which regulations, directives and other EU initiatives are – or will be – the most important in encouraging European companies across all industry sectors to switch to buying more clean power?

A complex landscape

When it comes to the decarbonisation agenda, the regulatory context has been moving rapidly since the European Green Deal was first presented in December 2019 – and particularly since the ‘Fit for 55’ package was proposed by the European Commission in 2021.

Our aim here is not to summarise all of the various pieces of legislation that are designed to accelerate the energy transition and reduce emissions. Instead, we will narrow the focus down – we will:

- concentrate on those regulations, directives and other EU initiatives which are specifically designed to encourage European companies to procure more clean power.

- consider legislative proposals which have not yet been approved, and legislation which has been approved but is not yet fully in force – so where some of the obligations on companies are still pending (i.e. we will not focus on directives and regulations which have already been implemented in full and where the obligations on companies are already in force).

If you apply those two ‘filters’, there are six pieces of legislation which will be the most important in encouraging companies to switch to renewable energy:

- The Corporate Sustainability Reporting Directive & the European Sustainability Reporting Standards

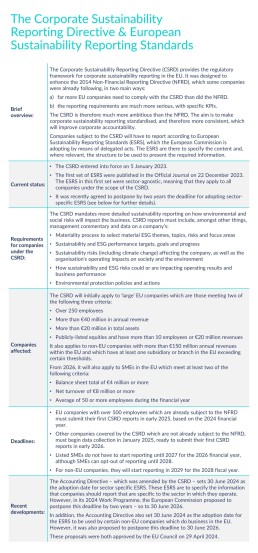

Sustainability reporting sits at the heart of the EU’s green strategy, and the Corporate Sustainability Reporting Directive (CSRD), which entered into force in January 2023, provides the regulatory framework for it. Companies subject to the CSRD will have to report according to European Sustainability Reporting Standards (ESRS), which the European Commission is adopting by means of delegated acts. The first set of ESRS were published in December 2023.

Here is a more detailed overview of the CSRD and ESRS:

- The Corporate Sustainability Due Diligence Directive

The Corporate Sustainability Due Diligence Directive (CSDDD) sets obligations for large companies regarding actual and potential adverse impacts on human rights and the environment, with respect to their own operations, those of their subsidiaries, and those carried out by their business partners:

- Reforming the design of the EU’s electricity market

In March 2023, the European Commission proposed a reform of the EU electricity market, with the aim of reducing price volatility for consumers and creating favourable conditions for investors in renewable energy. The reform includes two legislative proposals – one on electricity market design and the other on protection against wholesale energy market manipulation. One of the objectives is to support the use of more long-term instruments such as PPAs and contracts for difference (CfDs):

- EU-wide scheme for rating the sustainability of data centres

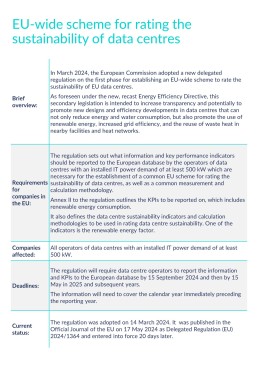

We referenced this in the previous article in this series, but on 14 March 2024, the European Commission adopted a new delegated regulation on the first phase for establishing an EU-wide scheme to rate the sustainability of EU data centres. With data centres estimated to account for close to 3% of EU electricity demand – a figure which is likely to significantly increase in the coming years – the scheme is intended to increase efficiency developments and to promote the use of renewable energy:

- The revised Directive on the Energy Performance of Buildings

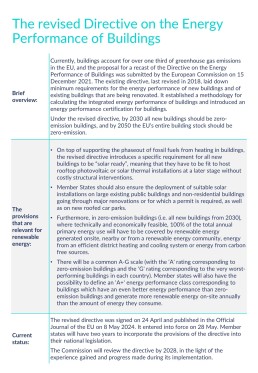

The revised Directive on the Energy Performance of Buildings entered into force on 28 May 2024. It is relevant for companies’ use of renewable energy because it introduces a specific requirement for all new buildings to be “solar ready”, and will ensure a much wider roll-out of solar installations on buildings and renewable energy capacity on-site:

- Proposal for a Directive on Green Claims

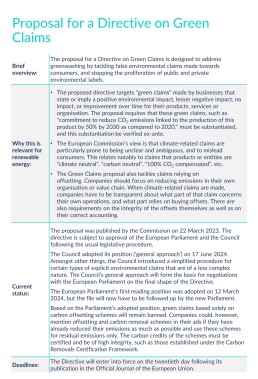

The proposal for a Directive on Green Claims is designed to address greenwashing. It is relevant to renewable energy because it tackles claims which rely on offsetting, emphasising the need for companies to focus on reducing emissions in their own organisation and value chain:

The regulatory landscape is making the transition to renewable energy a more and more urgent priority for companies across the EU

Since the European Parliament elections last month, there has been much talk about the ‘shift to the right’, with populist parties gaining seats across the EU – and what it might mean for the future of the Green Deal.

However, as will be clear from the overview above, much of the regulatory environment which is designed to encourage European companies to procure renewable energy is already in place – and it will not be unpicked by the new Parliament. The obligations on companies operating in the EU are coming, and as the deadlines approach, so the need to switch to clean power will only become more urgent.

What’s coming up next time?

Next time, we will be taking another sector deep-dive, this time into the industry which is leading the way when it comes to the amount of capacity that has been contracted through green PPAs: information & communications technology (ICT)…

Why is the telecoms industry amongst the fastest-growing sectors for renewable energy PPAs?

In the last article in this series, we took the first of several deep-dives we will be taking into industry sectors which are heavily impacted by the energy transition – and which are driving demand for renewable energy power purchase agreements (PPAs) in Central & South Eastern Europe.

We started with the automotive sector. This time, we will consider a sector which, according to industry estimates, accounts for 1-2% of all energy consumed globally – and in which the PPA market is growing even faster: the telecommunications industry.

- How does the telecoms industry compare with other sectors when it comes to signing green PPAs?

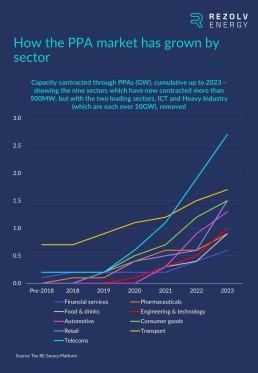

Right now, the telecoms industry sits third on the list of sectors which have contracted the most capacity through green PPAs, although it is well behind the two leading sectors on the list – ICT and heavy industry:

However, if you take ICT and heavy industry out of the equation, the telecoms industry has been the fastest-growing sector for contracting capacity via PPAs over the last five years:

- Which telecoms operators are leading the way?

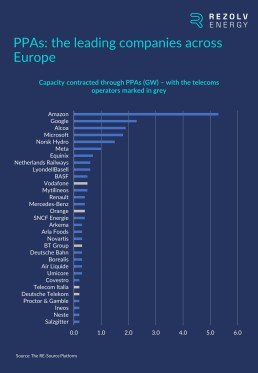

There are five telecoms operators – Vodafone, Orange, BT Group, Telecom Italia and Deutsche Telekom – in the group of 30 companies which have contracted the most clean power capacity through PPAs in Europe:

- Which companies dominate the telecoms sector in Central & South Eastern Europe?

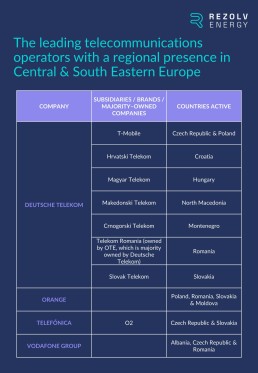

There are four telecoms operators which stand out in Central & South Eastern Europe because they have a significant presence in multiple countries across the region:

- What sustainability commitments have these companies made?

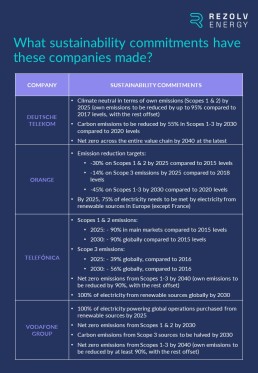

Three out of four of these companies are members of ‘RE100’, the global corporate renewable energy initiative which brings together businesses committed to 100% renewable electricity (Orange is the exception). More specifically, they have each made the following sustainability commitments:

- How is this translating into signed PPAs?

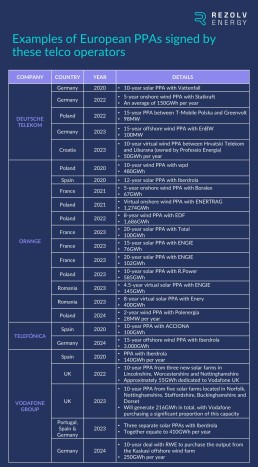

Here is an overview of the most important European PPAs signed by this group of telecoms companies:

- What is driving this interest in PPAs, and will it impact South Eastern Europe as well?

There is no question that this interest in green energy will transition into more telecoms industry PPAs being signed in South Eastern Europe. There are three main reasons for optimism:

- Telecoms operators use a lot of electricity, and decisions over renewable power cannot wait if the sector is to meet its sustainability commitments:

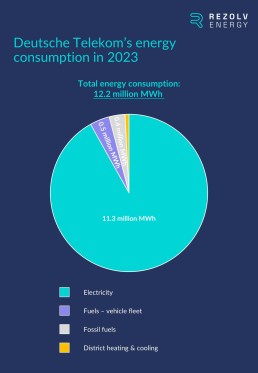

We mentioned in the previous article in this series that automobile assembly and parts manufacturing are energy-intensive processes that rely on electricity in particular. Electricity makes up an even larger share of the energy consumption mix for telecoms operators. This, for example, is how Deutsche Telekom’s energy consumption was split last year:

Telefónica’s share was even higher: electricity represented 95% of the company’s total energy consumption.

All of the major telecoms operators have made substantial efforts to reduce their energy consumption through energy efficiency initiatives, but it is not easy given that data traffic through their networks has increased so significantly over the last decade – and continues to increase. Telefónica and Deutsche Telekom have managed to reduce their total energy consumption slightly in recent years; Vodafone and Orange’s consumption has, however, continued to rise year-on-year.

Given this, the decarbonisation targets these companies have set themselves will not be achievable without renewable energy procurement at scale, and it will need to cover all subsidiaries and geographies.

- Renewable energy buying is being driven by the search for cost savings:

Procuring energy currently accounts for up to 40% of telecoms companies’ operational expenditure, and the search for cost savings helps explain the shift towards renewable energy that we have seen in recent years.

A recent article in Developing Telecoms explored this trend. In it, Enrique Dans, a Senior Fellow at the Centre for European Policy Analysis (CEPA), said this: “From my perspective, the most important factor here is cost. We are witnessing a huge decrease in the cost of renewable energy.”

The reality is that a well-structured PPA will, in the long-term, reduce a company’s energy costs compared to traditional utility rates – as well as shielding them from market fluctuations. As the telecoms industry has come to realise, there is a clear commercial rationale for signing a renewable energy PPA.

- European regulations are driving change:

Telecoms companies manage data centres which store vast amounts of information – and which also consume significant quantities of energy (a topic we will dive into in more detail later in this series).

Last month, the European Commission adopted a new delegated regulation on the first phase for establishing an EU-wide scheme to rate the sustainability of EU data centres. As foreseen under the new Energy Efficiency Directive, this secondary legislation requires data centre operators to report the KPIs to the European database by 15 September 2024, and then by 15 May in 2025 and subsequent years. With data centres estimated to account for close to 3% of EU electricity demand – a figure which is likely to significantly increase in the coming years – the scheme is intended to increase efficiency developments and to promote the use of renewable energy.

This delegated regulation is just one example of how EU legislation is steering companies towards renewable energy, but it is a particularly important one for telecoms companies and the broader ICT industry.

What is coming up next time?

Next time, we will be considering the final point above in more detail: which regulations, directives and other EU initiatives are the most important in shaping the energy buying priorities of companies across Europe? We will provide an overview…

Bekaert and Rezolv Energy sign 100 GWh wind Power Purchase Agreement in Romania

Bucharest, 4 July 2024: Rezolv Energy, the Actis-backed independent power producer in Central and Southeastern Europe, through their project subsidiary First Looks Solutions S.R.L., have signed a 10-year Virtual Power Purchase Agreement (VPPA) in Romania with Bekaert, a global leader in steel wire transformation and coating technologies. This is one of the largest PPAs ever signed in the region. The deal will see Bekaert buy 100 GWh of additional renewable power per year, reducing annual emissions by more than 41 000 tonnes of CO2e . The power will come from the 461MW ‘VIFOR’ wind farm, which has been developed by Rezolv and Low Carbon in Buzău County, Romania.

The PPA represents a new milestone in Bekaert’s Sustainability strategy “Creating a better tomorrow”. From making a positive impact with its sustainable solutions and practices, to building a diverse and inclusive future, Bekaert is determined to improve life and create value for all of its stakeholders. Through renewable energy projects like the VPPA in Romania, Bekaert increases the proportion of its renewable energy supply, reducing its carbon footprint as per its validated SBTi targets.

About the VIFOR Wind Farm

Once operational, VIFOR will be one of Europe’s largest onshore wind farms. Close to the Carpathian Mountains and benefiting from exceptional wind yields, the project will generate enough clean energy to power more than 270 000 homes and will avoid approximately 540 000 tonnes of CO2e annually. Phase 1 will install 192MW in capacity with planned expansion to 461MW in phase 2. Construction is scheduled to be completed within 18 months, with VIFOR coming onstream before the end of 2025.

In a region which has historically relied on fossil fuels for most of its energy needs, replacing fossil production with renewables delivers the maximum possible emissions reduction impact. The project will therefore play a crucial role in the region’s energy transition and support Romania in meeting its climate targets. It will also be developed to the highest international sustainability standards to ensure that it leaves a lasting, positive legacy.

Michael Hamilton, VP Commodities, Bekaert, said: “We are delighted to sign this exciting project in Romania with Rezolv. This agreement not only enhances our existing renewable energy portfolio but also exemplifies our commitment to sustainability and creating value for all of our stakeholders. By integrating renewable energy sources into our operations, we are taking significant steps towards a greener future for our company and the customers we serve.”

Alastair Hammond, CEO, Rezolv Energy, said: “We are proud to be contributing to Bekaert’s decarbonisation objectives through this VPPA. By signing it, Bekaert is also enabling the first phase of the VIFOR project, a large-scale wind farm which will play a significant role in Romania’s energy transition. Phase 2 will help us meet even more of the widespread corporate demand for clean power.”