What is driving the interest in PPAs that we are seeing from the automotive sector?

The first few articles in this series included some analyses of individual countries in Central and South Eastern Europe – specifically, Bulgaria, Romania and the Czech Republic.

It is now time for the first of several deep-dives into industry sectors which are heavily impacted by the energy transition – and which are driving most of the demand for renewable energy power purchase agreements (PPAs) in this region. We are going to start with an industry which has become almost synonymous with Central and South Eastern Europe: the automotive sector.

- How important is the automotive industry to Central and South Eastern Europe?

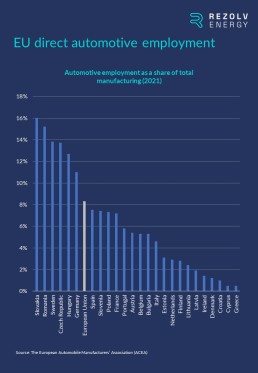

Over the last 30 years, Central and South Eastern Europe has become a key centre for automotive production in Europe – benefitting from its geographical proximity to the largest markets in Western Europe and relatively low labour costs. It continues to play an outsized role economically, with Slovakia, Romania, the Czech Republic and Hungary all in the top five countries in the EU when it comes to the proportion of jobs which are created directly by the automotive sector:

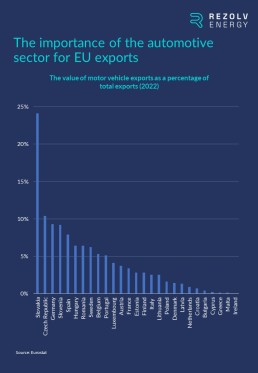

The economic value is not just in the jobs the sector supports: the industry is also a vital part of international trade in these countries. For example, motor vehicles make up almost a quarter of the total value of exports from Slovakia, and contribute a very substantial proportion in the Czech Republic (10.4%), Slovenia (9.2%), Hungary (6.4%) and Romania (6.4%) too:

- Which companies dominate the automotive sector in Central and South Eastern Europe?

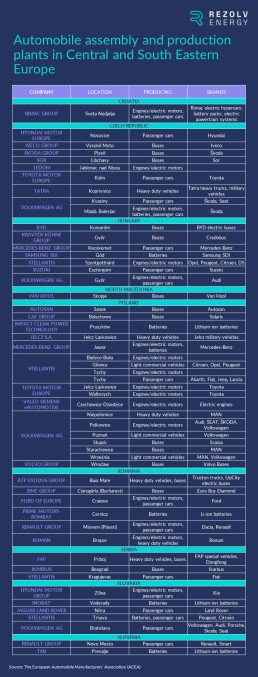

There is a long list of automotive companies with production and/or assembly plants in Central & South Eastern Europe:

The list is dominated by the biggest names in the industry – including all of the world’s top five automotive companies: Volkswagen (Czech Republic, Hungary, Poland and Slovakia), Toyota (Czech Republic and Poland), Stellantis (Hungary, Poland, Serbia and Slovakia), the Mercedes-Benz Group (Hungary and Poland) and Ford (Romania).

However, as we explained in the last article in this series, the reason that the automotive sector contributes so much economically is not just explained by the presence of these multinational giants. It is also a consequence of the huge number of smaller local firms in their supply chains.

- What sustainability commitments have these companies made?

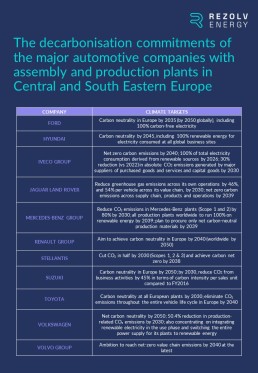

If we narrow it down and focus in on the biggest brand names from the list above (which primarily means the passenger car manufacturers), they have all committed to firm decarbonisation deadlines:

As we also explained last time, many of these targets cover ‘Scope 3’ (the entire supply chain) as well as ‘Scope 1’ (the company’s direct greenhouse gas emissions) and ‘Scope 2’ (the emissions caused indirectly through the production of the energy the company purchases / uses). This is a positive development because Scope 3 emissions represent 80% of the total environmental impact for many large companies. However, it is also a major challenge in Central and South Eastern Europe, where there are so many smaller companies supplying these multinationals. To hold on to those contracts, these businesses will need to contribute to their customers’ carbon neutrality targets by reducing their own emissions – and demonstrate that they have done so.

- Has this yet translated into automotive firms signing green PPAs?

With the transport and mobility sector accounting for about 23% of global energy-related greenhouse gas emissions, the automotive sector has been under heavy pressure to reduce its carbon footprint to comply with the Paris Climate Agreement – and, compared with other sectors, the automotive industry has set relatively stretching net zero targets.

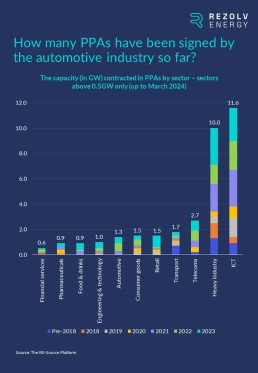

However, despite that, the sector is lagging behind several others when it comes to the amount of capacity that has so far been contracted through green PPAs:

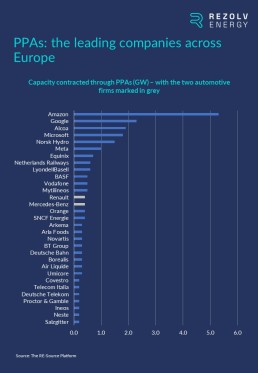

Indeed, at a European level, there are only two automotive companies – Renault and the Mercedes-Benz Group – in the group of 30 companies which have contracted the most clean power capacity through PPAs:

Mercedes-Benz was actually was actually amongst the very first movers on PPAs. The company signed its first PPA in 2018, agreeing to buy electricity generated at a 45MW wind farm 10 kilometres away from its manufacturing facility in Jawor, Poland. That was simultaneously the first PPA in this region and the first automotive sector PPA anywhere in Europe.

At the very beginning of 2019, Mercedes-Benz went on to sign Germany’s first corporate PPA, and, last year, two further (much larger) PPAs in its home market – for 140MW and 120MW, both wind power. In February this year, Mercedes-Benz also signed another wind PPA in Poland.

Renault, on the other hand, has preferred a mix of wind and solar PPAs. In 2021, the company signed a PPA with Iberdrola covering 100% of Renault’s electricity needs in Spain, which included the implementation of photovoltaic and wind projects at the company’s facilities. Subsequently, in November 2022, Renault announced the largest corporate PPA ever signed in France – 350MW of solar, enough to cover up to 50% of the electricity consumption of its production activities in France in 2027.

- 2024 will be the year when things start to accelerate – but what is driving the interest we are now seeing in PPAs in the automotive sector?

So far, there has been far less movement on PPAs from the automotive sector in Central and South Eastern Europe, but there have been two recent deals:

- Photon New Energy Alfa Kft signed a 20-year on-site PPA with FORVIA Clarion Hungary, a subsidiary of the automotive technology firm FORVIA, for the construction and operation of a solar PV plant on the client’s factory in Nagykáta, about 80 kilometres southeast of Budapest.

- Swiss-based Axpo signed a 10-year PPA with industrial product supplier Kolektor to buy up to 200 GWh of renewable electricity over ten years. The electricity will be used at Kolektor Mobility’s facility in Slovenia, which produces components and systems for electric vehicles.

This is an encouraging sign that things are changing, and that 2024 will be a transformative year. There are three other reasons why we are so optimistic about the outlook for this year:

- Decisions over renewable power cannot be deferred if the sector is to meet its decarbonisation commitments:

Automobile assembly and parts manufacturing are energy-intensive processes that rely on electricity in particular. This is responsible for considerable CO2 emissions which is why renewable energy procurement will need to play a central role if the major automotive companies present in this region are to meet their decarbonisation targets. Given the deadlines, these are also not decisions which can be delayed much longer.

- Automotive companies prefer PPAs:

As we have seen, PPAs in the automotive sector have really started to take off over the last three years in Europe. As a recent analysis of the PPA market in the automotive sector from SP Global concluded, “car manufacturers in the EU and US largely prefer PPAs, with green tariffs following. The automotive sector began to confidently gain momentum in the PPA market in North America and Europe. Its average annual growth in 2019-22 reached 50%, which makes it stand out compared with other manufacturing sectors.”

- Available capacity:

That same SP Global analysis made one other very important point. It said that “the rate of progress in green procurement across major car manufacturers appears to be closely dependent on…the renewable generation capacity in the region where manufacturing plants are present.”

Fortunately, renewable energy capacity is now coming onstream in volume in Central and South Eastern Europe and so, really for the first time, the energy sector can meet the corporate demand for green electricity from automotive firms.

What is coming up next time?

Next time, we will be taking another sector deep-dive – this time into the telecoms industry…