In the last article in this series, we explored the regulations, directives and other EU initiatives which are – or will be – the most important in encouraging European companies to switch to buying more renewable power. One of the pieces of legislation highlighted was a new delegated regulation on the first phase for establishing an EU-wide scheme to rate the sustainability of EU data centres, which was adopted in March 2024. The regulation establishes a European database for operators of data centres with an installed IT power demand of at least 500 kW, and requires those operators to report on various KPIs by 15 September 2024 – and then by 15 May in 2025 and subsequent years.

The regulation is very important for the telecoms industry, which we considered earlier in this series, and even more so for the subject of this article: the information & communications technology (ICT) sector. In this piece, we will explore why the ICT industry – and the growth of data centres specifically – is so significant for the development of renewable energy in Central and South Eastern Europe, and therefore to Rezolv’s mission in the region:

- How does the ICT sector compare with other industry sectors when it comes to renewable energy procurement?

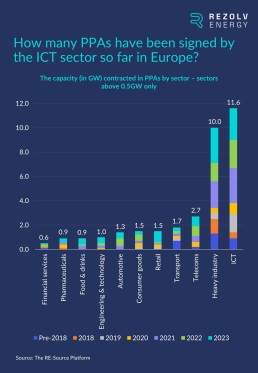

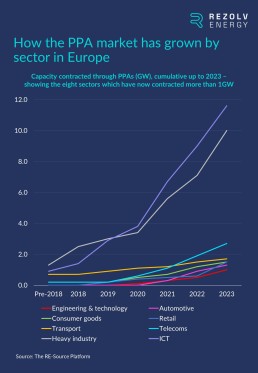

The ICT industry was leading the way on renewable energy purchasing in Europe well before the EU-wide scheme to rate the sustainability of EU data centres was on the agenda. Indeed, across Europe, ICT companies have contracted more than four times the amount of green energy capacity through Power Purchase Agreements (PPAs) than any other sector apart from Heavy Industry:

Heavy Industry was actually a slightly earlier adopter of the PPA model than ICT, but ICT moved ahead in 2019 and has stretched its lead since then:

2. Which ICT companies are leading the way on PPAs in Europe?

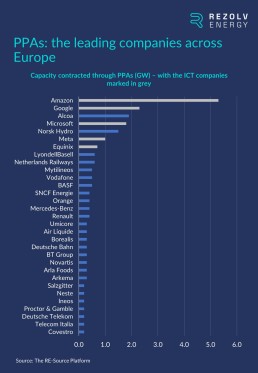

More than any other sector, the ICT industry’s track record of signing PPA deals is dominated by a relatively small number of companies. When you consider the list of companies which have contracted the largest amount of capacity through PPAs in Europe, there are five ICT companies in the top seven: four of the traditional ‘Big Five’ tech companies (Amazon, Google, Microsoft and Meta) plus Equinix, the only business outside the ‘Big Five’ which breaks into the list of top five data centre companies worldwide:

3. Overall, how much progress has each of these companies made when it comes to renewable energy procurement?

Compared to many other industries, these five companies all have very strong track records when it comes to renewable energy purchasing:

- Amazon: In 2019, Amazon set a goal to match 100% of the electricity it used with renewable energy by 2030. This goal was achieved in 2023, seven years early. Last year, BloombergNEF named Amazon the world’s largest corporate purchaser of renewable energy for the fourth year in a row, buying more solar and wind power than the next three companies combined. In that 12-month period, Amazon announced 74 individual PPAs across 16 different markets, totalling 8.8GW of capacity. Overall, this brought Amazon’s announced corporate PPA portfolio to 33.6GW.

- Google: In 2017, Google matched 100% of its annual electricity consumption globally with renewable energy for the first time. It has gone on to repeat that feat every year since, with the company contracting 1GW through PPAs last year.

- Microsoft: In 2023, Microsoft increased its contracted portfolio of renewable energy assets to more than 19.8GW, including projects in 21 countries, and signed new PPAs in Brazil, the US, New Zealand and Poland. In FY23, the company’s total renewable electricity use stood at 23.6 million MWh, and it aims to reach 100% renewable energy next year.

- Meta: As of 2020, Meta’s global operations have been supported by 100% renewable energy. Globally, the company was second on the list of renewable energy buyers in 2023, announcing 3GW of PPAs.

- Equinix: In 2023, Equinix maintained 96% renewable energy coverage across its global footprint, its sixth consecutive year of 90%+ renewable energy coverage. The company’s goal to achieve 100% renewable energy coverage by 2030.

- Given how much progress has already been made by the world’s largest ICT companies, is there much scope for continued growth in the volume of renewable energy purchased?

The answer to this question is a resounding ‘yes’.

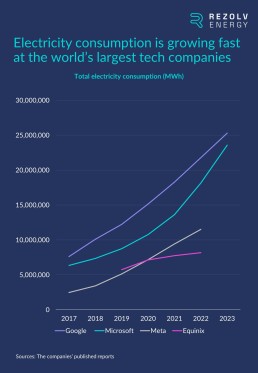

The issue for all of these businesses is that maintaining such high levels of renewable energy coverage will be incredibly challenging given their rising electricity consumption. The chart below considers four of these companies – Google, Microsoft, Meta and Equinix – and provides an indication of the scale of the task:

The primary issue is the rapid growth in the volume of data that these companies are processing. For example, electricity consumption in Meta’s data centres was 97% of the company’s total electricity consumption in 2022. More data requires ever higher computational power, and scaling up processing capacities in data centres requires more electricity. As the International Energy Agency (IEA) has clarified, the extra electricity is required not only for additional equipment such as servers, but also for cooling to deal with the immense heat build-up from data processing.

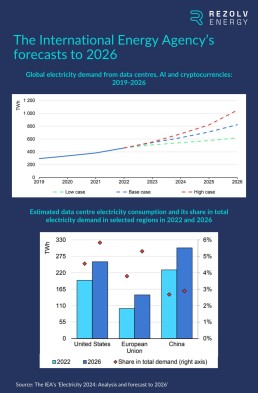

The concern now is that the additional computational power needed for the rapid growth of Artificial Intelligence models and their applications will only accelerate the already soaring electricity demand. On average, a ChatGPT query requires nearly 10 times as much electricity to process as a Google search, and the IEA estimated earlier this year that electricity consumption from data centres, AI and the cryptocurrency sector could double by 2026. Having consumed an estimated 460 TWh in 2022, the IEA forecasts that data centres’ total electricity consumption could reach more than 1,000 TWh in 2026, roughly equivalent to the electricity consumption of Japan:

This, of course, has major implications for the Big Tech companies’ sustainability targets as well.

For example, in July, Google revealed that its greenhouse gas emissions had climbed 48% over the past five years (and 13% between 2022 and 2023), blaming electricity consumption from data centres and supply chain emissions as the primary cause of the increase. The company admitted that its goal of reaching net zero emissions by 2030 “won’t be easy” and confirmed that there was now “significant uncertainty” about its ability to reach that target.

Microsoft also admitted in May this year that energy use related to its data centres was endangering its “moonshot” target of being carbon negative by 2030. Brad Smith, Microsoft’s President, said that “the moon has moved” due to the company’s AI strategy.

5. Are there other factors which will encourage further renewable energy procurement in the ICT sector?

If we retain our focus on the Big Tech companies, there is one other important factor which will also drive more corporate PPAs. Earlier in this series, we considered the impact of companies committing to net zero across the entire production chain – so covering Scope 3 emissions as well as Scope 1 (emissions occurring from sources that are controlled or owned by the company) and Scope 2 (indirect emissions associated with the purchase of power).

Of the companies we have been considering so far, we have already mentioned Microsoft’s pledge to be carbon negative by 2030 and Google’s target to achieve net-zero emissions across its value chain by 2030. Google has also implemented a ‘Google Renewable Energy Addendum’ that asks its largest hardware manufacturing suppliers to commit to achieving a 100% renewable energy match by 2029.

Meta has the same 2030 target as Google, and Equinix has committed to achieving a 50% reduction in Scope 3 emissions from fuel and energy-related activities by 2030.

Amazon aims to be net-zero carbon by 2040 and, based on the company’s most recent sustainability report, has “identified a list of the highest-emitting suppliers directly supporting our operations, and expect those suppliers, who collectively contribute more than 50% of emissions globally to Amazon’s Scope 3 footprint, to provide a plan for how they will decarbonize their operations and demonstrate real progress over time. We will prioritize our business toward those who provide their plans and results on their path to net zero carbon emissions.”

Over time, this pressure on suppliers from multinational companies with comprehensive net zero commitments will also become an important driver of PPAs in Europe.

6. Will this affect Central and South Eastern Europe significantly?

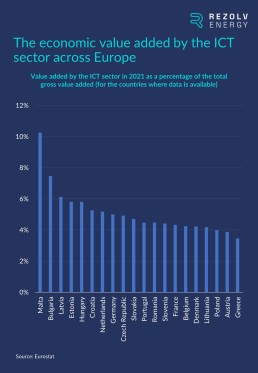

These trends are not restricted to the handful of very large companies at the very top of the ICT industry – they are being felt right across the sector and are impacting much smaller companies too. This matters for Central and South Eastern Europe because ICT is a very significant industry for many countries in this region. To assess this, it’s useful to consider the EU member states where the ICT sector adds the most value economically:

The data is not complete for every country, but based on these numbers, there is no obvious divide between Western Europe and Central / Eastern Europe when it comes to the importance of the ICT sector. In fact, of the seven countries where the ICT industry contributes more than 5% of the total value added, five are from CEE: Bulgaria, Latvia, Estonia, Hungary and Croatia.

There is a bigger geographical split when it comes to the number of data centres situated across Europe. The most developed Western European countries host the largest number of data centres, but there are still significant numbers in CEE:

This is a fast-moving space, though, and things could change very quickly. For example, in mid-July, the Romanian government and Google signed a memorandum of understanding on cooperation projects in “digital infrastructure, innovation and research”. The announcement did not provide specific details about Google’s plans in Romania, but it did mention Romania’s attractiveness for data centre projects and local press reports have indicated that Google is in negotiations to invest $2 billion in developing data centres in the country.

It is also important to note that, as has been proved by Rezolv’s recent deals with T-Mobile Czech Republic, Slovak Telekom, CE Colo Czech Republic, Bekaert and Ardagh Glass Packaging-Europe, the virtual PPA (VPPA) model has removed national borders as a barrier to renewable energy procurement within the EU.

In contrast to a physical PPA which require the buyer and producer to be in the same country, or in neighbouring countries with connected grids, a VPPA is a financial arrangement where the buyer receives certificates verifying that the energy has come from a specific renewable source, with the clean power being fed into the grid.

This means that even if a tech company’s electricity demand is concentrated in Western Europe, the door is open for them to benefit from the renewable energy boom that is underway in South Eastern Europe and procure clean power from a project (or projects) in this region.

Summing up: there is no time to lose

ICT companies should act now to ensure they are first in line for green power.

This starts with understanding the power usage efficiency of data centre providers and alternative suppliers, but it will also drive interest in green PPAs, including in Central and South Eastern Europe.

What is coming up next time?

Next time, we will be looking at another important, if slightly lower-profile, industry sector when it comes to green PPAs: retail…

You might also like

15 October 2025

VIFOR Wind Farm Progress Update

The construction of Rezolv’s VIFOR wind farm in Romania is moving forward at pace.

14 October 2025

Central & Southeastern Europe’s renewables revolution: which countries are leading the race to decarbonise?

Earlier in this series, at the end of Q1 2024, we considered 2030 emissions targets and provided a ‘status update’ on the progress the countries in Central & Southeastern Europe (CEE) had made in 2023.

6 October 2025

Rezolv offers 100 free training places in renewable energy, in partnership with RenewAcad

Rezolv Energy, one of the leading renewable energy producers in Central and Southeastern Europe, is offering 100 free training places in Buzău County, Romania, to help local people gain the skills needed for tomorrow’s clean energy jobs.

3 October 2025

Rezolv Energy receives EU grant for battery energy storage project in Bulgaria

Rezolv Energy has secured a grant from the European Union under the NextGenerationEU programme for the deployment of a Battery Energy Storage System (BESS) at the St. George solar power plant in Bulgaria.

14 August 2025

Rezolv Energy a major winner in Romania’s second contracts for difference (CfD) auction

Rezolv Energy, backed by growth market sustainable infrastructure investor Actis, has been awarded three contracts for difference (CfDs) by the Romanian Ministry of Energy in the country’s second CfD auction.

31 July 2025

Rezolv Energy selects partners for Phase 2 of the VIFOR wind farm in Romania

Rezolv Energy, backed by growth market sustainable infrastructure investor Actis, has selected its key partners for Phase 2 of the VIFOR Wind Farm in Buzău County, Romania.

22 July 2025

Rezolv Energy signs incremental €331 million finance facilities to bring its VIFOR wind farm in Romania to full capacity

Actis-backed Rezolv Energy, through its project subsidiary First Look Solutions S.R.L., has signed incremental project finance facilities of up to €331 million to support construction of the 269MW second phase of its VIFOR wind farm in Buzău County, Romania. Phase 2 will take the project to its full 461MW capacity.

1 July 2025

Rezolv Energy and SCION Launch Nature and CleanTech Accelerator for Early-Stage Ventures in Bulgaria and Romania

Rezolv Energy and SCION have announced the launch of the SCION Accelerator, a 10-week programme to support early-stage teams working at the intersection of ecology, science and scalable technology in Bulgaria and Romania.

19 February 2025

Why has the retail sector moved into the big leagues when it comes to renewable energy procurement?

In the last article in this series, we undertook a deep-dive into the ICT industry and why it – and the growth of data centres specifically – is so significant for the development of renewable energy in Central and Southeastern Europe.