Rezolv launched 18 months ago to accelerate the energy transition in Central & South Eastern Europe. We already have well over 2GW of clean energy being prepared for construction. This includes St. George, which will become one of Bulgaria’s largest solar plants, and Dama Solar, which will be the largest solar project anywhere in Europe once it is operational. We also have more than 1GW of wind power under construction in Romania.

When you tell people that story, it typically leads to one question: why Romania and Bulgaria?

This is the first in a series of articles that we will be publishing about the clean energy transition in Central & South Eastern Europe. We’re going to start by focusing on Bulgaria. The second article, which will be out in a couple of weeks’ time, will answer the ‘Why Romania?’ question.

An ‘emissions first’ approach.

So why Bulgaria?

There isn’t a straightforward, single factor answer to that question. There are various reasons, many of which are connected to the characteristics of the St. George project. St. George will be built on the site of the former Silistra airport, a decommissioned airfield covering 165 hectares. At 229MW, it is, like all of Rezolv’s projects, utility-scale. Solar projects of this size require a few different things – not least available land, good solar irradiation and capacity for grid access close to the site. St. George had all of these things.

But if you zoom out from the specifics of the project, there is a broader answer to the question which helps explain Rezolv’s mission – and that of Actis, Rezolv’s single shareholder. Actis is one of the world’s most respected energy investors, and one of the reasons Actis prioritised Central & South Eastern Europe is because it is a region which has historically relied on fossil fuels for most of its energy needs. Replacing fossil fuel production with renewables delivers the maximum possible emissions reduction impact – an ‘emissions first’ approach which aligns with the sustainability policies which are now being adopted by some of the world’s biggest companies, including Meta, Amazon and General Motors.

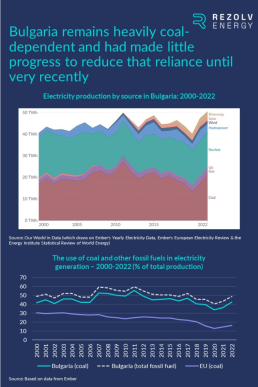

Bulgaria is a perfect example of this emissions reduction potential. Bulgarian electricity production is still heavily dependent on fossil fuels – particularly brown coal, or lignite, which makes up more than 85% of that fossil fuel total. This is a major problem because while lignite is the cheapest source of electricity from fossil fuels, it causes the highest CO2 emissions per ton when burned, one-third more than hard coal and three times as much as natural gas.

In 2022, 48.8% of Bulgaria’s electricity generation was produced by fossil fuels, almost identical to the situation in 2000 – so limited progress was made in the 20+ years leading up to 2022 in reducing Bulgaria’s dependence on lignite:

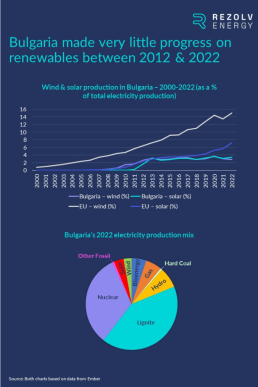

One explanation for this is that, over the same period, Bulgaria made limited progress in developing wind and solar capacity. Bulgaria was a relatively slow-starter on renewables: wind power was introduced, in small quantities, in 2006; solar production only got going in 2010. Both industries experienced a ‘boom’ between 2010 and 2013, but after that, the ‘pause’ button was pushed on new renewables capacity for a decade:

The good news is that the wheels are now turning and the energy transition is well underway in Bulgaria – in particular on solar, where capacity increased by more than 80% in 2023:

The energy transition is an economic as well as a political priority

This progress on solar establishes the extent to which the energy transition has become a political priority. The main drivers are obvious. First, the need to enhance energy security by reducing dependence on foreign sources of energy has, of course, risen to the top of the political agenda since the start of the war in Ukraine. And second, Bulgaria has some challenging climate targets to hit (a topic we will be returning to later in this series).

But there is also a third, slightly lower-profile factor: accelerating the energy transition has become an economic imperative too. Bulgaria is amongst the most heavily industrialised economies anywhere in Europe:

Later in the series, we will explore this factor in more detail, but for now, it is sufficient to note that much of Bulgaria’s industry is integrated into the supply chains of major pan-European industrial businesses. More and more of these multinationals are committing to comprehensive net-zero and renewable energy targets. However, in most cases, they have moved faster in this area than the majority of their suppliers – who will need to catch up quickly and meet their major customers’ renewable energy consumption requirements if they are to hold on their contracts. Enabling Bulgarian companies to procure clean power will therefore be vital to their long-term viability – and to the economic competitiveness of the country as a whole.

The PPA potential in Bulgaria

For this reason, the news just before Christmas that the Bulgarian Sustainable Energy Development Agency (SEDA)’s application to join the Association of Issuing Bodies (AIB) had been accepted was hugely welcome. This concerns guarantees of origin (GOs), which prove to a final customer that the energy they are buying has been produced from renewable sources. AIB membership is necessary for GOs to be transferred between EU member states, which is essential for many of the multinational firms that are driving the demand for power purchase agreements (PPAs). AIB membership will therefore remove a key barrier to the signing of corporate PPAs in Bulgaria – which will also lead to more renewable energy projects being built there.

The impact of renewable energy on the Bulgarian public

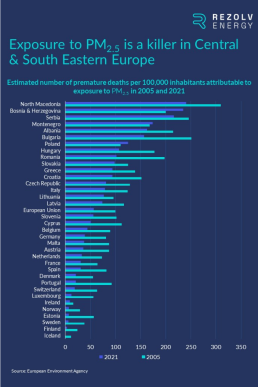

Finally, let’s not forget the impact of renewable energy on the general public. In Bulgaria, the growth of wind and the further development of solar will have a direct, tangible impact on human health, which is another reason why investing there is so attractive. This is specifically because air quality remains a huge problem. There are many different air pollutants, but one of the most significant for human health is fine particulate matter (PM2.5), with exposure to PM2.5 at above recommended levels a leading cause of premature death and disease (particularly stroke, cancer and respiratory disease).

PM2.5 levels are a serious problem across the whole of Central & South Eastern Europe. Across the region, the European Environment Agency concludes that high PM2.5 levels are “due primarily to the burning of solid fuels like coal for domestic heating and their use in industry”. And it’s a killer – with Bulgaria number one on the EU list when it comes to premature deaths attributable to exposure to PM2.5:

This focus on the human dimension of the energy transition translates to local community relations as well. Rezolv has always taken the view that, without the support of the communities that live close to our sites, we would not be able to build and operate our projects successfully. Leaving a lasting, positive legacy for local communities is more than just the right thing to do: it’s business critical. We are therefore committed to creating long-term value for the communities living around St. George by working with local stakeholders to create opportunities and improve living standards for local people – both current generations and those to come. In so doing, we intend for St. George to set a standard for the responsible development of renewable energy projects in Bulgaria which others will be inspired to follow.

Summing up

So, to sum up, why are we investing in Bulgaria? Because the development of renewable energy will have a tangibly positive impact on human health there. And because the energy transition is at the heart of Bulgaria’s ongoing industrial competitiveness, with PPAs offering Bulgarian companies an emissions reduction guarantee – as well as long-term price stability and peace of mind over the security of supply. On top of that, PPAs help finance the construction of new renewable energy projects. It’s a virtuous circle.

What is coming up next time?

Is this context the same in Romania? Not exactly. There is still an ‘emissions first’ rationale for investing there, but the investment case is not identical.

And that is what we will be exploring next time…

You might also like

1 July 2025

Rezolv Energy and SCION Launch Nature and CleanTech Accelerator for Early-Stage Ventures in Bulgaria and Romania

Rezolv Energy and SCION have announced the launch of the SCION Accelerator, a 10-week programme to support early-stage teams working at the intersection of ecology, science and scalable technology in Bulgaria and Romania.

19 February 2025

Why has the retail sector moved into the big leagues when it comes to renewable energy procurement?

In the last article in this series, we undertook a deep-dive into the ICT industry and why it – and the growth of data centres specifically – is so significant for the development of renewable energy in Central and Southeastern Europe.

16 October 2024

Rezolv Energy secures up to €90 million in debt financing from the IFC and Raiffeisen Bank International for the St. George solar park in Bulgaria

Rezolv Energy, an independent power producer backed by Actis, has secured up to €90 million in debt financing from the International Finance Corporation (IFC) and Raiffeisen Bank International to support the construction of the ‘St. George’ solar park in north-eastern Bulgaria.

30 September 2024

Rezolv Energy and A2A sign Virtual Power Purchase Agreement for 150 GWh of wind energy in Romania

A2A, an Italian group active in the energy, water and environment sectors, has signed a 7-year Virtual Power Purchase Agreement (VPPA) with Rezolv Energy, an independent power producer backed by Actis.

18 September 2024

ICT companies should act now to secure the green power needed for data centre growth

In the last article in this series, we explored the regulations, directives and other EU initiatives which are – or will be – the most important in encouraging European companies to switch to buying more renewable power.

6 September 2024

Ardagh Glass Packaging-Europe enters Bulgarian renewable energy market by signing Virtual Power Purchase Agreement with Rezolv Energy

Ardagh Glass Packaging-Europe (AGP-Europe), an operating business of Ardagh Group, announced today that it has entered a long-term Virtual Power Purchase Agreement (VPPA) with Rezolv Energy’s St. George solar photovoltaic (PV) project in Bulgaria, securing renewable electricity for its glass manufacturing operations across Europe from April 2026.

6 September 2024

Rezolv Energy hands contracts to three companies, including Solarpro and CMC Europe, to build the ‘St. George’ solar park in Bulgaria

Actis-backed Rezolv Energy has selected three companies – CMC Europe, Solarpro and Green Solar Energy – to build the 229MW ‘St. George’ solar park in Silistra Municipality in Northeastern Bulgaria. Construction work is due to start very shortly, with the plant coming onstream next year.

18 July 2024

Which regulatory changes at EU level are doing – or will do – the most to push companies towards renewable power?

In the last article in this series, we took a deep-dive into the telecommunications industry, a sector which, according to industry estimates, accounts for 1-2% of all energy consumed globally – and which is amongst the fastest-growing for renewable energy power purchase agreements (PPAs).

11 July 2024

Why is the telecoms industry amongst the fastest-growing sectors for renewable energy PPAs?

In the last article in this series, we took the first of several deep-dives we will be taking into industry sectors which are heavily impacted by the energy transition – and which are driving demand for renewable energy power purchase agreements (PPAs) in Central & South Eastern Europe.