Earlier in this series, at the end of Q1 2024, we considered 2030 emissions targets and provided a ‘status update’ on the progress the countries in Central & Southeastern Europe (CEE) had made in 2023. Our conclusion? That “the progress we have seen across the region over the last 12 months is a great start, but even more urgency is needed.”

18 months on, we have a clearer sense of how fast the region is moving – and which countries are leading the way.

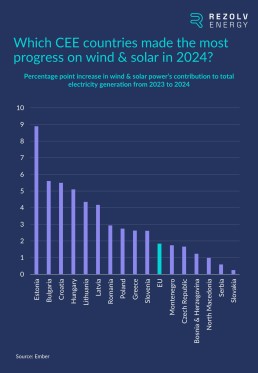

Which CEE countries made the most progress last year?

Let’s start by looking at how much installed wind and solar capacity was added by each CEE country in 2024, and how that compares with the EU average:

This is, clearly, very encouraging. Some might point out that it is easier for CEE countries to increase the proportion of wind and solar when: a) many of them started 2024 from a lower base than the EU average, and b) they are mostly relatively small countries, where every installed megawatt has a more sizeable impact than it would in a larger country. However, the fact that 10 CEE countries added more wind and solar capacity as a percentage of total electricity generation than the EU average is still good news, and a 5%+ uptick in a single year – delivered by Estonia (+8.89%), Bulgaria (+5.60%), Croatia (+5.49%) and Hungary (+5.10%) – should not be underestimated in any country. It is a very significant achievement indeed.

There is one other important detail about these figures which cannot be read from this graph. Almost all of the wind and solar additions last year were, in reality, solar power capacity. In 2024, wind energy’s contribution to total electricity generation only increased by more than 1% in two CEE countries: Estonia (+5.58%) and Croatia (+2.27%)

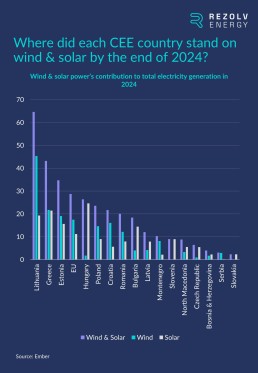

Where did the region stand at the end of 2024?

Estonia’s outstanding performance last year took it above the EU average for the contribution made by wind and solar power, becoming the third CEE country (alongside Lithuania and Greece) to surpass that benchmark:

Also notable is the fact that all three of these countries are ahead of the EU average for both wind and solar. No other CEE country is above the EU average for wind power.

The other big ‘mover’ from the CEE region last year was Bulgaria, which exceeded the EU average for solar power for the first time. Hungary, the other CEE country which finished 2024 well ahead of the EU average for solar, was already double the EU average by the end of 2023.

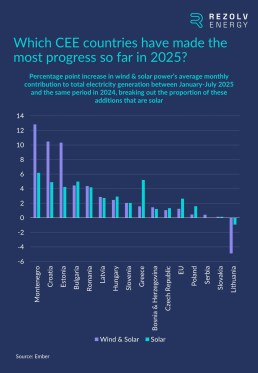

How much further progress has been made so far this year?

Analysing monthly renewable energy generation statistics can be difficult because the volume of power produced by wind and solar naturally fluctuates. For example, between January and July 2025, the EU as a whole produced 7.26% less wind power than in the same period in 2024. Why? Simply because some important regions – notably Germany – experienced some of their least windy conditions in 15 years, directly impacting electricity output.

This is why, in the analysis below which compares the first seven months of 2025 with the same period last year, several countries added more solar power than the total for wind and solar together – and why a country like Lithuania, for example, appears to have gone backwards:

The positive news here is that five countries added more than 4% of wind and solar on average between January and July – notably better than both the rest of CEE and the EU average: Montenegro (+12.8%), Croatia (10.5%), Estonia (10.3%), Bulgaria (4.5%) and Romania (4.4%).

Can we expect these five countries to continue to set the pace within CEE?

In each case, there is quite a lot of evidence to indicate that this answer is ‘yes’:

- Montenegro

The Montenegrin government is strongly supportive of the energy transition having adopted two pieces of legislation – on energy and on renewable energy sources – over the past year.

Admir Šahmanović, Minister of Energy and Mining, also said in May that his priority is to mobilise larger investments, with the first large projects scheduled to come online in 2026. He also said that Montenegro had received 45 applications from investors to build renewable power plants with a combined capacity of 5.5GW (by way of comparison, the country’s current capacity is slightly over 1GW).

Subsequently, in July, Montenegro opened its first renewable energy auction with the support of the European Bank for Reconstruction and Development (EBRD), targeting 250MW of solar power generation.

Finally, later in the same month, Montenegro published its draft National Energy and Climate Plan (NECP) for public consultation. The draft NECP states that, with existing measures (WEM), there will be a 42.5% share of renewables in gross final energy consumption (and a 66.3% share of renewables in electricity production) by 2030. With additional measures (WAM), it could reach 53.3% in gross final energy consumption and 79.4% in electricity production.

All of these factors indicate that, while Montenegro might be near the start of its energy transition curve, it should make very substantial progress over the next few years.

- Croatia

Croatia’s final updated NECP, submitted in April 2025, indicated the same target as Montenegro for renewables in gross final energy consumption: 42.5%. This aligned with the EU’s own minimum target.

As well as its strong performance on renewables over the last 18 months, the positive signs for Croatia include the fact that it was one of the first countries in the region to embrace renewable energy auctions, launching an auction for 607MW of capacity in April last year (450MW of solar, 150MW of wind and 7.25MW of hydro). Ultimately, 413.5MW of solar and 4.5MW of hydropower capacity were awarded. No wind projects were selected, but the process marked an important step forward and helped maintain momentum in the transition.

However, challenges remain. In August, the Renewable Energy Sources of Croatia Association (RES Croatia) highlighted that, while Croatia’s cumulative solar capacity reached 1.099GW by mid-2025, the utility-scale segment is largely stagnant due to regulatory barriers. Chief among these is the failure to implement a legally required transmission grid connection fee since 2022, which is holding up around 50 projects, most of them solar, with a combined capacity of 3GW. Additional restrictions around energy storage development were cited as another obstacle.

- Estonia

Political support for renewables also remains strong in Estonia. In November, the government approved a draft law to accelerate the deployment of renewable energy by increasing financial benefits for local authorities and streamlining planning procedures. Then, in June 2025, Estonia’s final updated NECP included an ambitious target: renewables to account for at least 65% of gross final energy consumption by 2030, with 100% of electricity generation coming from renewable sources.

Meeting this goal will not be easy. In February, while celebrating a record year for solar additions, Eesti Taastuvenergia Koda (the Estonian Renewable Energy Association) warned that solar growth may be slowing. The rapid expansion of solar projects had already led to 236 hours of zero or negative electricity prices in 2024 – indicating that “the market is now already somewhat saturated and the rapid growth will likely stop soon”.

As a result, future electricity auctions will exclude solar and focus exclusively on wind, which has grown more slowly but can deliver crucial winter generation.

Eesti Taastuvenergia Koda also flagged another challenge: the small size of the Estonian market makes power purchase agreements (PPAs) harder to secure. However, greater standardisation and regulation at EU level could improve PPA frameworks, making it easier for companies to enter agreements and further accelerate renewables development.

- Bulgaria

At the start of this year, Bulgaria’s Electricity System Operator (ESO) confirmed that renewable electricity capacity increased by 938MW in 2024 across 481 separate projects – all of them solar (no new wind projects have been commissioned in Bulgaria for more than a decade). This was slightly below the 1.2 GW of solar installed in 2023, but momentum remains strong.

The absence of new wind capacity is a challenge, yet solar continues to drive Bulgaria’s energy transition. A recent analysis by Capital projected that large-scale PV projects alone could add 1.5GW by the end of H1 2026, taking Bulgaria’s total installed solar capacity to 6GW.

Capital highlighted three projects exceeding 200MW:

- The Simeonovgrad-Polyanovo PV project, which comprises the 70MW Simeonovgrad park and the 180MW Polyanovo park. It is located in the Haskovo region in the southern part of the country, and is expected to be put into operation early next year.

- The Tenevo project in southeastern Bulgaria, the largest hybrid power plant in the country. The first phase (69 MWp) was commissioned last month. The second phase will take capacity to 237.6MW by early 2026, with plans for an additional 250MW of wind to follow.

- Rezolv’s own 225MW George solar park in Silistra Municipality, will come onstream at the beginning of 2026, generating 313GWh of clean electricity per year.

Another important development is the upcoming ability to transfer guarantees of origin (GOs) across Bulgarian borders. This a vital mechanism for multinational companies looking to secure credible renewable energy supply through PPAs, and is possible through the Association of Issuing Bodies (AIB)’s inter-registry communications Hub. In Bulgaria, the Issuing Body is the Sustainable Energy Development Agency (SEDA), which became an official member of the AIB in 2024. SEDA is on track to join the AIB Hub in 2025, enabling Bulgaria to issue GOs and transfer them across borders. This step will accelerate the PPA market, helping finance further renewable energy capacity.

- Romania

According to Romania’s final updated NECP, published in October 2024, the country aims to achieve at least 38.3% of renewable energy in gross final energy consumption by 2030, equivalent to 32.3GW of renewable power. While slightly below the European Commission’s recommended target of 41%, this should not be interpreted as a lack of ambition. In fact, Romania added 900MW-1GW of solar over the first six months of 2025, including 500-550MW of utility-scale projects, taking Romania’s total installed solar capacity close to 6GW. As a result, for the first time, solar-generated electricity has surpassed output from coal and gas-fired plants.

On top of that, the Romanian Wind Energy Association Romania has estimated that Romania could reach 6.5GW of installed wind capacity by 2028.

Romania is also leading the region in Contracts for Difference (CfDs). Two auctions have been completed, with a third – focused on wind – currently under consideration.

Rezolv has been awarded four CfDs through the first two auctions. In the first, we were the winning wind bid for 240MW of capacity from the VIFOR wind farm in Buzău County. In the second, Rezolv was awarded three CfDs, covering 731.2MW of capacity from our 1,044MW Dama Solar PV project in Arad County (which, once built, is expected to be the largest solar plant anywhere in Europe) and the full capacity from our 300MW Dunarea East wind farm in Constanța County.

The Romanian government allocated more capacity in the second CfD auction, and set up the eligibility rules to facilitate support for very large-scale projects like Dama Solar and Dunarea East – underlining the importance of major wind and solar parks in driving the energy transition. The CfDs will enable us to move forward quickly into the construction phase at both projects where, ultimately, they will add more than 1.3GW of clean power to Romania’s grid.

The region’s 2030 targets are still some way off

Over the past 18 months, CEE has demonstrated that progress is possible at speed. Countries like Estonia, Croatia, Montenegro, Bulgaria and Romania are proving that strong policy frameworks, competitive auctions and the corporate demand for clean power can deliver real results. However, the gap between leaders and laggards in the region remains significant, and the race to meet 2030 targets is, even amongst the leaders, far from over.

What is coming up next time?

In our next article, we will explore what needs to happen in the second half of this decade to maintain momentum. Which policy reforms will be critical? How can regulatory bottlenecks be cleared? And what role will large-scale renewable projects and corporate PPAs play in closing the gap?

You might also like

6 October 2025

Rezolv offers 100 free training places in renewable energy, in partnership with RenewAcad

Rezolv Energy, one of the leading renewable energy producers in Central and Southeastern Europe, is offering 100 free training places in Buzău County, Romania, to help local people gain the skills needed for tomorrow’s clean energy jobs.

3 October 2025

Rezolv Energy receives EU grant for battery energy storage project in Bulgaria

Rezolv Energy has secured a grant from the European Union under the NextGenerationEU programme for the deployment of a Battery Energy Storage System (BESS) at the St. George solar power plant in Bulgaria.

14 August 2025

Rezolv Energy a major winner in Romania’s second contracts for difference (CfD) auction

Rezolv Energy, backed by growth market sustainable infrastructure investor Actis, has been awarded three contracts for difference (CfDs) by the Romanian Ministry of Energy in the country’s second CfD auction.

31 July 2025

Rezolv Energy selects partners for Phase 2 of the VIFOR wind farm in Romania

Rezolv Energy, backed by growth market sustainable infrastructure investor Actis, has selected its key partners for Phase 2 of the VIFOR Wind Farm in Buzău County, Romania.

22 July 2025

Rezolv Energy signs incremental €331 million finance facilities to bring its VIFOR wind farm in Romania to full capacity

Actis-backed Rezolv Energy, through its project subsidiary First Look Solutions S.R.L., has signed incremental project finance facilities of up to €331 million to support construction of the 269MW second phase of its VIFOR wind farm in Buzău County, Romania. Phase 2 will take the project to its full 461MW capacity.

1 July 2025

Rezolv Energy and SCION Launch Nature and CleanTech Accelerator for Early-Stage Ventures in Bulgaria and Romania

Rezolv Energy and SCION have announced the launch of the SCION Accelerator, a 10-week programme to support early-stage teams working at the intersection of ecology, science and scalable technology in Bulgaria and Romania.

19 February 2025

Why has the retail sector moved into the big leagues when it comes to renewable energy procurement?

In the last article in this series, we undertook a deep-dive into the ICT industry and why it – and the growth of data centres specifically – is so significant for the development of renewable energy in Central and Southeastern Europe.

16 October 2024

Rezolv Energy secures up to €90 million in debt financing from the IFC and Raiffeisen Bank International for the St. George solar park in Bulgaria

Rezolv Energy, an independent power producer backed by Actis, has secured up to €90 million in debt financing from the International Finance Corporation (IFC) and Raiffeisen Bank International to support the construction of the ‘St. George’ solar park in north-eastern Bulgaria.

30 September 2024

Rezolv Energy and A2A sign Virtual Power Purchase Agreement for 150 GWh of wind energy in Romania

A2A, an Italian group active in the energy, water and environment sectors, has signed a 7-year Virtual Power Purchase Agreement (VPPA) with Rezolv Energy, an independent power producer backed by Actis.