In the last article in this series, we took the first of several deep-dives we will be taking into industry sectors which are heavily impacted by the energy transition – and which are driving demand for renewable energy power purchase agreements (PPAs) in Central & South Eastern Europe.

We started with the automotive sector. This time, we will consider a sector which, according to industry estimates, accounts for 1-2% of all energy consumed globally – and in which the PPA market is growing even faster: the telecommunications industry.

- How does the telecoms industry compare with other sectors when it comes to signing green PPAs?

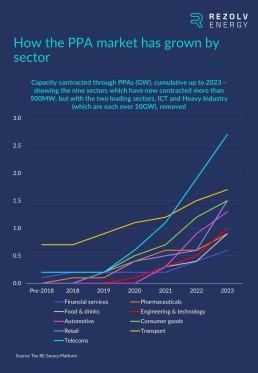

Right now, the telecoms industry sits third on the list of sectors which have contracted the most capacity through green PPAs, although it is well behind the two leading sectors on the list – ICT and heavy industry:

However, if you take ICT and heavy industry out of the equation, the telecoms industry has been the fastest-growing sector for contracting capacity via PPAs over the last five years:

- Which telecoms operators are leading the way?

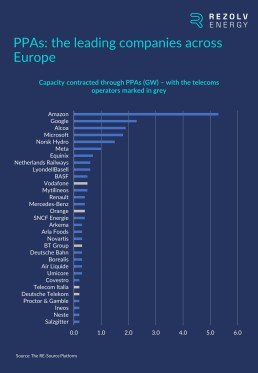

There are five telecoms operators – Vodafone, Orange, BT Group, Telecom Italia and Deutsche Telekom – in the group of 30 companies which have contracted the most clean power capacity through PPAs in Europe:

- Which companies dominate the telecoms sector in Central & South Eastern Europe?

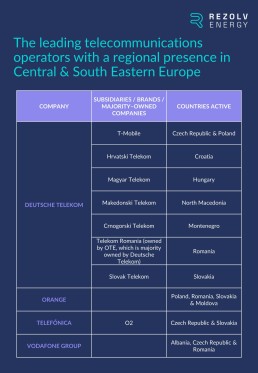

There are four telecoms operators which stand out in Central & South Eastern Europe because they have a significant presence in multiple countries across the region:

- What sustainability commitments have these companies made?

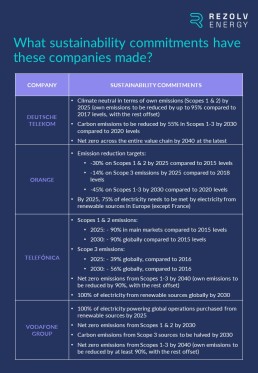

Three out of four of these companies are members of ‘RE100’, the global corporate renewable energy initiative which brings together businesses committed to 100% renewable electricity (Orange is the exception). More specifically, they have each made the following sustainability commitments:

- How is this translating into signed PPAs?

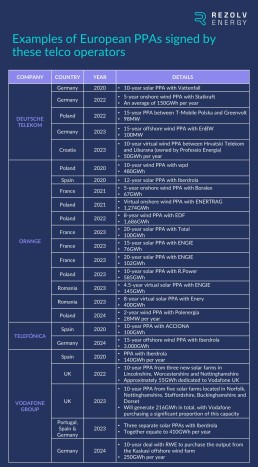

Here is an overview of the most important European PPAs signed by this group of telecoms companies:

- What is driving this interest in PPAs, and will it impact South Eastern Europe as well?

There is no question that this interest in green energy will transition into more telecoms industry PPAs being signed in South Eastern Europe. There are three main reasons for optimism:

- Telecoms operators use a lot of electricity, and decisions over renewable power cannot wait if the sector is to meet its sustainability commitments:

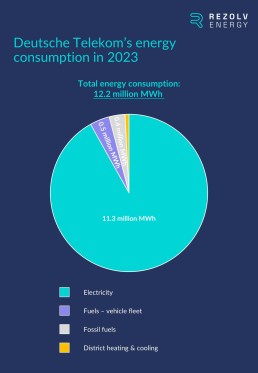

We mentioned in the previous article in this series that automobile assembly and parts manufacturing are energy-intensive processes that rely on electricity in particular. Electricity makes up an even larger share of the energy consumption mix for telecoms operators. This, for example, is how Deutsche Telekom’s energy consumption was split last year:

Telefónica’s share was even higher: electricity represented 95% of the company’s total energy consumption.

All of the major telecoms operators have made substantial efforts to reduce their energy consumption through energy efficiency initiatives, but it is not easy given that data traffic through their networks has increased so significantly over the last decade – and continues to increase. Telefónica and Deutsche Telekom have managed to reduce their total energy consumption slightly in recent years; Vodafone and Orange’s consumption has, however, continued to rise year-on-year.

Given this, the decarbonisation targets these companies have set themselves will not be achievable without renewable energy procurement at scale, and it will need to cover all subsidiaries and geographies.

- Renewable energy buying is being driven by the search for cost savings:

Procuring energy currently accounts for up to 40% of telecoms companies’ operational expenditure, and the search for cost savings helps explain the shift towards renewable energy that we have seen in recent years.

A recent article in Developing Telecoms explored this trend. In it, Enrique Dans, a Senior Fellow at the Centre for European Policy Analysis (CEPA), said this: “From my perspective, the most important factor here is cost. We are witnessing a huge decrease in the cost of renewable energy.”

The reality is that a well-structured PPA will, in the long-term, reduce a company’s energy costs compared to traditional utility rates – as well as shielding them from market fluctuations. As the telecoms industry has come to realise, there is a clear commercial rationale for signing a renewable energy PPA.

- European regulations are driving change:

Telecoms companies manage data centres which store vast amounts of information – and which also consume significant quantities of energy (a topic we will dive into in more detail later in this series).

Last month, the European Commission adopted a new delegated regulation on the first phase for establishing an EU-wide scheme to rate the sustainability of EU data centres. As foreseen under the new Energy Efficiency Directive, this secondary legislation requires data centre operators to report the KPIs to the European database by 15 September 2024, and then by 15 May in 2025 and subsequent years. With data centres estimated to account for close to 3% of EU electricity demand – a figure which is likely to significantly increase in the coming years – the scheme is intended to increase efficiency developments and to promote the use of renewable energy.

This delegated regulation is just one example of how EU legislation is steering companies towards renewable energy, but it is a particularly important one for telecoms companies and the broader ICT industry.

What is coming up next time?

Next time, we will be considering the final point above in more detail: which regulations, directives and other EU initiatives are the most important in shaping the energy buying priorities of companies across Europe? We will provide an overview…

You might also like

15 October 2025

VIFOR Wind Farm Progress Update

The construction of Rezolv’s VIFOR wind farm in Romania is moving forward at pace.

14 October 2025

Central & Southeastern Europe’s renewables revolution: which countries are leading the race to decarbonise?

Earlier in this series, at the end of Q1 2024, we considered 2030 emissions targets and provided a ‘status update’ on the progress the countries in Central & Southeastern Europe (CEE) had made in 2023.

6 October 2025

Rezolv offers 100 free training places in renewable energy, in partnership with RenewAcad

Rezolv Energy, one of the leading renewable energy producers in Central and Southeastern Europe, is offering 100 free training places in Buzău County, Romania, to help local people gain the skills needed for tomorrow’s clean energy jobs.

3 October 2025

Rezolv Energy receives EU grant for battery energy storage project in Bulgaria

Rezolv Energy has secured a grant from the European Union under the NextGenerationEU programme for the deployment of a Battery Energy Storage System (BESS) at the St. George solar power plant in Bulgaria.

14 August 2025

Rezolv Energy a major winner in Romania’s second contracts for difference (CfD) auction

Rezolv Energy, backed by growth market sustainable infrastructure investor Actis, has been awarded three contracts for difference (CfDs) by the Romanian Ministry of Energy in the country’s second CfD auction.

31 July 2025

Rezolv Energy selects partners for Phase 2 of the VIFOR wind farm in Romania

Rezolv Energy, backed by growth market sustainable infrastructure investor Actis, has selected its key partners for Phase 2 of the VIFOR Wind Farm in Buzău County, Romania.

22 July 2025

Rezolv Energy signs incremental €331 million finance facilities to bring its VIFOR wind farm in Romania to full capacity

Actis-backed Rezolv Energy, through its project subsidiary First Look Solutions S.R.L., has signed incremental project finance facilities of up to €331 million to support construction of the 269MW second phase of its VIFOR wind farm in Buzău County, Romania. Phase 2 will take the project to its full 461MW capacity.

1 July 2025

Rezolv Energy and SCION Launch Nature and CleanTech Accelerator for Early-Stage Ventures in Bulgaria and Romania

Rezolv Energy and SCION have announced the launch of the SCION Accelerator, a 10-week programme to support early-stage teams working at the intersection of ecology, science and scalable technology in Bulgaria and Romania.

19 February 2025

Why has the retail sector moved into the big leagues when it comes to renewable energy procurement?

In the last article in this series, we undertook a deep-dive into the ICT industry and why it – and the growth of data centres specifically – is so significant for the development of renewable energy in Central and Southeastern Europe.