In the last article in this series, we undertook a deep-dive into the ICT industry and why it – and the growth of data centres specifically – is so significant for the development of renewable energy in Central and Southeastern Europe.

This time we will be looking at another sector – retail – which may not be able to compete with ICT in terms of the total amount of renewable electricity contracted through power purchase agreements (PPAs), but which is growing even faster. We will consider the most important factors driving that growth, and explore what the implications might be for Southeastern Europe.

1. How does retail compare with other industry sectors when it comes to renewable energy procurement?

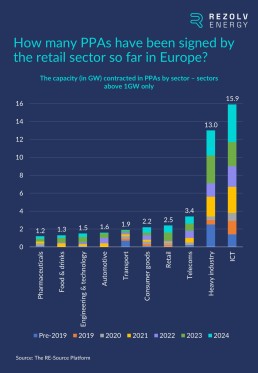

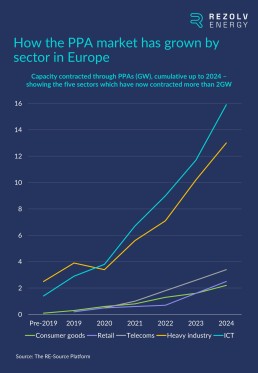

The put things into context, the retail sector currently stands fourth on the list of sectors which has contracted the most green energy through PPAs, with 2.5GW in total. There is a 0.9GW gap to the telecoms industry (a sector we explored earlier in this series) in third, and then a chasm to the two leading sectors: ICT (13GW) and heavy industry (15.9GW):

However, over the last two years, retail has been the fastest-growing sector of all, increasing contracted capacity by 257% between 2022 to 2024 (albeit from a relatively low base). In the same time period, telecoms grew by 89%, heavy industry by 83%, ICT by 77% and consumer goods by 69%:

2. Which retailers are leading the way?

The retail sector is slightly different to ICT, which is dominated by a relatively small number of big tech companies when it comes to the signing of PPA deals.

Pexapark’s ‘Renewables Market Outlook 2025’ included two retailers – Carrefour and Tesco – in its Top 10 list of corporate PPA buyers in 2024, the first time any supermarket chains had made that list. However, a quick look at the most significant retail sector PPAs in 2024 indicates that while most were signed by supermarket chains, there was a variety of companies and countries, and a good mix of both wind and solar PPAs:

3. What is driving retailers towards green PPAs?

There are four main factors driving this move towards renewable energy PPAs in the retail sector. Three of them are not specific to retail; the final one is a bigger factor in retail than in the other sectors we have explored so far in this series (automotive, telecoms and ICT).

Let’s start with the factors which are not unique to retail:

a) PPAs can reduce energy costs for electricity-intensive companies, as well as protecting them from volatile energy markets

It is not a coincidence that supermarket chains dominate the list of retailers which signed the most significant PPAs last year. Supermarkets typically have a large footprint – which is one reason rooftop solar has been so popular in the sector – with ranks of fridges and freezers running 24/7. This makes supermarkets the most energy-intensive form of retail.

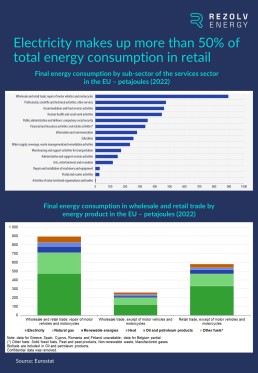

More specifically, retail is electricity-intensive, with electricity making up well over half of total energy consumption:

This means two things:

- Electricity consumption is a major contributor to supermarkets’ total carbon emissions (if the electricity is not coming from renewable sources)

- Supermarkets’ electricity bills can be very high indeed – a substantial component in overall operating costs. These chains are therefore particularly vulnerable to price shocks within the global energy market, and soaring bills in recent times have eaten into their margin.

We will come back to the first point. On the second point, a well-structured PPA will, in the long-term, reduce a company’s energy costs compared to traditional utility rates. There is therefore a clear commercial rationale for signing a renewable energy PPA. PPAs also offer long-term price stability, protecting companies from volatile energy markets. It is for these reasons that supermarket chains – the form of retail with the highest electricity bills – have been driving demand for PPAs within the sector.

b) European retailers are being influenced by the regulatory environment at EU level

Earlier in this series, we examined the regulations, directives and other EU initiatives which are – or will be – the most important in encouraging European companies to switch to buying more clean power. We highlighted six in particular: the Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS), the Corporate Sustainability Due Diligence Directive (CSDDD), the reform of the EU’s electricity market design, the EU-wide scheme for rating the sustainability of data centres, the revised Directive on the Energy Performance of Buildings and the proposal for a Directive on Green Claims.

European retailers are impacted by nearly all of these regulations, and as the deadlines for compliance approach, so the need to switch to clean power has become more urgent.

c) Major retailers have made sustainability commitments which they now need to meet

As we saw in our previous sector deep-dives, corporations are under increasing pressure from a wide range of stakeholders – governments, investors, employees, customers etc. – to improve the environmental performance of their operations.

Retail is no exception. For example, 29 retailers are members of ‘RE100’, the global initiative which brings together businesses committed to 100% renewable electricity. Nine of these are retailers headquartered in Europe: Decathlon, Inditex (which owns Zara and Massimo Dutti, among other brands), Ingka Group (the largest IKEA franchisee holding company), BayWa, H&M, JD Sports Fashion, Next, Tesco and Zalando.

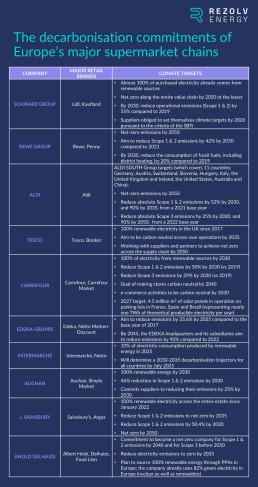

If we focus in again on Europe’s major supermarket chains, most of them have robust sustainability targets with deadlines which are approaching fast:

These three factors, then, are not specific to retail – they affect all industry sectors. There is also one additional factor which is not exactly specific to retail, but to which retailers are particularly sensitive: consumer attitudes.

Every industry must be attuned to the needs of their customers, of course, but no sector is more competitive than retail, nor is any sector more responsive to changing habits within the customer base. In retail, success or failure is determined by attention to these details, and by the speed with which companies adapt to them.

This is important in the context of renewable energy procurement because survey after survey has shown that consumers are becoming increasingly conscious of the environmental footprint of the products they buy, and of their shopping habits more broadly. This is affecting purchasing decisions, even as the costs of consumer goods have risen.

For example, PwC’s inaugural ‘Voice of the Consumer Survey’ was published in May 2024 and collected the perspectives of more than 20,000 consumers across 31 countries and territories. Almost half of the respondents (46%) said that they are buying more sustainable products as a way to reduce their personal impact on the environment. Across the board, consumers also said that they would be willing to pay 9.7% above the average price for sustainably produced or sourced goods:

These attitudes are particularly strong amongst younger shoppers, but it emphasises the link that exists between shopping habits and retailers’ approach to sustainability. Efforts to reduce emissions connect with many customers, and can therefore be a way of enhancing brand loyalty – thereby providing a vital competitive advantage.

4. What is the situation in Southeastern Europe?

Many retailers across Southeastern Europe have also started to transition across to green electricity. To give a few examples:

- IKEA: Ingka Group, the owner of most IKEA stores worldwide, has invested over €4 billion in renewable energy projects, including wind farms and solar parks. In Romania, Ingka Group acquired a 300MW solar photovoltaic project in Dâmbovița County, expected to be operational by late 2025.

- Lidl: In Romania, Lidl inaugurated a logistics centre in Fundeni, Călărași County in 2023, which was equipped with 2,650 solar panels and covered over 9,400 m2. These panels are projected to generate approximately 30% of the facility’s energy needs.

Lidl Bulgaria has solar panels on two logistics centres – in the villages of Ravno Pole and Kabile – each with a capacity of 1000 kWp, as well as at 50 of the chain’s stores across the country. All of the power produced is used for Lidl’s own needs. Last year alone, the company’s investments in the construction of PV systems exceeded 7 million leva (€3.6 million). Almost the same amount is planned for this financial year.

- Kaufland: Kaufland Bulgaria has also been proactive in installing PV systems. By March 2023, the company had activated 420 kWp of rooftop solar panels across six sites, including locations in Petrich and Sofia’s Mladost 4 district. Additionally, Kaufland Romania partnered with Enel X to implement a PV system at its logistics centre in Turda, installing over 2,000 panels to cover more than 19.3% of the facility’s annual electricity consumption.

- Billa: In October 2023, Electrohold Trade and Billa Bulgaria entered into a 10-year PPA to supply Billa with green electricity from a solar power plant. Billa has also installed solar panels on the parking lot of one of its stores in Sofia, as well as on the roof of a nearby commercial facility, together producing 20% of the store’s consumption. The system also includes 130kWh of battery storage. This year, Billa Bulgaria plans to invest 4.5 million leva (€2.3 million) in PV systems, including at the company’s new logistics centre.

- Metro: Since 2020, PV systems have been installed on the roofs of three Metro Bulgaria stores – in Blagoevgrad, Pleven and Veliko Tarnovo. Each of the solar installations there occupies an area of approximately 3,000 m2, with the energy produced covering an average of 25% of the needs of the respective store.

2025 may well be the year we start to see more retail sector PPAs in Southeastern Europe

Summing up, the strong growth in renewable energy PPAs that we have seen in the retail sector over the last two years is a result of several factors, including soaring electricity costs, regulatory pressure and the sustainability commitments many retailers have made. They have been commercial decisions aimed at avoiding volatile energy prices eating into the bottom line, with the added benefits of enhancing the ability to plan long-term and building stronger brand loyalty amongst customers.

These factors will not change, which is why the growth of renewable energy procurement in the retail sector is not a short-term trend. It is a strategic shift which is here to stay – and, as we have seen in Western Europe, expect retail to become one of the fastest-growing sectors of all when it comes to renewable energy procurement in Southeastern Europe as well.

What is coming up next time?

Earlier in this series, just under a year ago, we considered 2030 emissions targets and provided a ‘status update’ on how the countries in Central & Southeastern Europe were progressing. Our conclusion? That “the progress we have seen across the region over the last 12 months is a great start, but even more urgency is needed.”

12 months on, many of these targets have increased again and, now less than five years out from 2030, we have an even clearer sense of the situation. Next time, we will provide a revised status update on the growth of renewable energy across the region and assess whether or not countries are on track to meet their various climate goals…

You might also like

15 October 2025

VIFOR Wind Farm Progress Update

The construction of Rezolv’s VIFOR wind farm in Romania is moving forward at pace.

14 October 2025

Central & Southeastern Europe’s renewables revolution: which countries are leading the race to decarbonise?

Earlier in this series, at the end of Q1 2024, we considered 2030 emissions targets and provided a ‘status update’ on the progress the countries in Central & Southeastern Europe (CEE) had made in 2023.

6 October 2025

Rezolv offers 100 free training places in renewable energy, in partnership with RenewAcad

Rezolv Energy, one of the leading renewable energy producers in Central and Southeastern Europe, is offering 100 free training places in Buzău County, Romania, to help local people gain the skills needed for tomorrow’s clean energy jobs.

3 October 2025

Rezolv Energy receives EU grant for battery energy storage project in Bulgaria

Rezolv Energy has secured a grant from the European Union under the NextGenerationEU programme for the deployment of a Battery Energy Storage System (BESS) at the St. George solar power plant in Bulgaria.

14 August 2025

Rezolv Energy a major winner in Romania’s second contracts for difference (CfD) auction

Rezolv Energy, backed by growth market sustainable infrastructure investor Actis, has been awarded three contracts for difference (CfDs) by the Romanian Ministry of Energy in the country’s second CfD auction.

31 July 2025

Rezolv Energy selects partners for Phase 2 of the VIFOR wind farm in Romania

Rezolv Energy, backed by growth market sustainable infrastructure investor Actis, has selected its key partners for Phase 2 of the VIFOR Wind Farm in Buzău County, Romania.

22 July 2025

Rezolv Energy signs incremental €331 million finance facilities to bring its VIFOR wind farm in Romania to full capacity

Actis-backed Rezolv Energy, through its project subsidiary First Look Solutions S.R.L., has signed incremental project finance facilities of up to €331 million to support construction of the 269MW second phase of its VIFOR wind farm in Buzău County, Romania. Phase 2 will take the project to its full 461MW capacity.

1 July 2025

Rezolv Energy and SCION Launch Nature and CleanTech Accelerator for Early-Stage Ventures in Bulgaria and Romania

Rezolv Energy and SCION have announced the launch of the SCION Accelerator, a 10-week programme to support early-stage teams working at the intersection of ecology, science and scalable technology in Bulgaria and Romania.

16 October 2024

Rezolv Energy secures up to €90 million in debt financing from the IFC and Raiffeisen Bank International for the St. George solar park in Bulgaria

Rezolv Energy, an independent power producer backed by Actis, has secured up to €90 million in debt financing from the International Finance Corporation (IFC) and Raiffeisen Bank International to support the construction of the ‘St. George’ solar park in north-eastern Bulgaria.